Stock (Symbol) |

Fortinet (FTNT) |

Stock Price |

$128 |

Sector |

| Technology |

Data is as of |

| December 9, 2020 |

Expected to Report |

| Februry 4 |

Company Description |

Fortinet, Inc. is a network security company. The Company provides cyber security solutions to a range of enterprises, service providers and government organizations across the world. Its network security solution consists of FortiGate physical, virtual machine and cloud platforms, which provide integrated security and networking functions to protect data, applications and users from network-and content-level security threats. The Company’s product offerings consist of its FortiGate product family, along with its FortiManager central management and FortiAnalyzer central logging and reporting product families. Its cybersecurity platform includes a range of products, which include its FortiMail e-mail security, FortiSandbox advanced threat protection (ATP), FortiWeb Web application firewall, FortiDDos and FortiDB database security appliances, as well as its FortiClient endpoint security software, FortiAP secure wireless access points and FortiSwitch secure switch connectivity products. Source: Thomson Financial Fortinet, Inc. is a network security company. The Company provides cyber security solutions to a range of enterprises, service providers and government organizations across the world. Its network security solution consists of FortiGate physical, virtual machine and cloud platforms, which provide integrated security and networking functions to protect data, applications and users from network-and content-level security threats. The Company’s product offerings consist of its FortiGate product family, along with its FortiManager central management and FortiAnalyzer central logging and reporting product families. Its cybersecurity platform includes a range of products, which include its FortiMail e-mail security, FortiSandbox advanced threat protection (ATP), FortiWeb Web application firewall, FortiDDos and FortiDB database security appliances, as well as its FortiClient endpoint security software, FortiAP secure wireless access points and FortiSwitch secure switch connectivity products. Source: Thomson Financial |

Sharek’s Take |

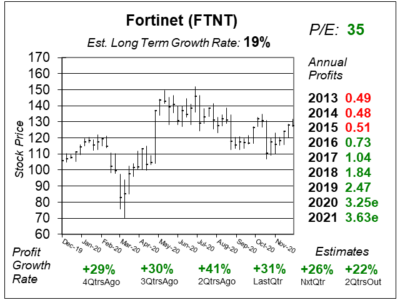

Fortinet (FTNT) isn’t as fancy as some of the high-ocatane cybcersecrity stocks. But what FTN does have is a reasonable valuation (P/E). The stock sells for just 35x 2021 earnings estimates. And I think this stock is a good one for conservative investors who want technology in their portfolio, but don’t want the risk of owning a stock with a P/E of 100 or more. Fortinet (FTNT) isn’t as fancy as some of the high-ocatane cybcersecrity stocks. But what FTN does have is a reasonable valuation (P/E). The stock sells for just 35x 2021 earnings estimates. And I think this stock is a good one for conservative investors who want technology in their portfolio, but don’t want the risk of owning a stock with a P/E of 100 or more.

Fortinet is a one-stop-shop that can handle all the cybersecurity needs for organizations. Many companies utilize multiple cybersecurity vendors to handle different tasks within the organization. Then the different systems have to be patched together to work together. The majority of Fortune 100 companies are Fortinet customers and the company even works with Interpol to identify cyber thieves around the world. The company derives its revenue from a mix of product sales, security subscription services, and technical support:

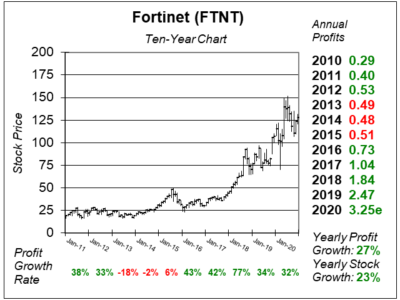

Years-ago, Fortinet spent on adjusting its products for a cloud computing environment. This caused annual profits to suffer 2013-2015. Now, FTNT is growing good again. Profits have grown 43%, 42%, 77% and 34% the past four years and analysts predict 32% growth this year. Yet the stock has a P/E of just 35. The company is doing so well, it has a stock buyback plan in place. Fortinet is one of the faster-growing stocks in the Conservative Growth Portfolio. But it’s slow-growing when compared to Palo Alto Networks, Zscaler and Crowdstrike. |

One Year Chart |

FTNT has been a weak stock the past six months. It’s been frustrating to own. Thus, I don’t have the stock ranked high in my Power Rankings. It doesn’t have much momentum. FTNT has been a weak stock the past six months. It’s been frustrating to own. Thus, I don’t have the stock ranked high in my Power Rankings. It doesn’t have much momentum.

During the past three qtrs, the P/E has come down from 52 to 39 and now 35. This stock seems to be a good value. The Est. LTG of 19% is very good for a semi-conservative tech stock. |

Earnings Table |

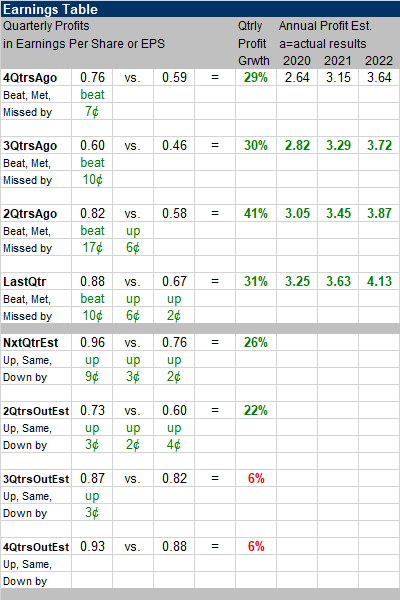

Last qtr, FTNT delivered profit growth of 31% which beat estimates of 16%. This company has whipped earnings estimates the last 5 qtrs. Revenue growth was 19% last qtr with billings growth at 20%. The company saw strong demnd for secure SD-WAN, high-end Fortigate and cloud solutions. Product revenue increased 14% and service revenue rose 22%. Last qtr, FTNT delivered profit growth of 31% which beat estimates of 16%. This company has whipped earnings estimates the last 5 qtrs. Revenue growth was 19% last qtr with billings growth at 20%. The company saw strong demnd for secure SD-WAN, high-end Fortigate and cloud solutions. Product revenue increased 14% and service revenue rose 22%.

Annual Profit Estimates increased across the board. Qtrly profit Estimates are good with 26%, 22%, 6% and 6% growth expected the next 4 qtrs. If FTNT can beat the street the next 2 qtrs it might continue to grow profits at 30% or more. Notice these estimates have been trending higher. |

Fair Value |

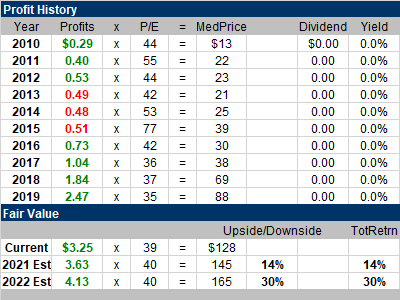

My Fair Value P/E comes down this qtr, from 50 t0 40. I just don’t think this stock is going to get a high valuation. It seems like investors are flocking to cloud-based cybcer stocks. The stock currently has a P/E of 39 when calculated with 2020 profit estimates. There is decent upside for this stock when we look to 2021. My Fair Value P/E comes down this qtr, from 50 t0 40. I just don’t think this stock is going to get a high valuation. It seems like investors are flocking to cloud-based cybcer stocks. The stock currently has a P/E of 39 when calculated with 2020 profit estimates. There is decent upside for this stock when we look to 2021. |

Bottom Line |

Fortinet (FTNT) has a nice ten-year chart. The last four years have been very good. In this ten-year chart, notice profits didn’t hit record highs during 2013-2015. At that time the company was investing in development that has enabled Fortinet to be the force it is today. Fortinet (FTNT) has a nice ten-year chart. The last four years have been very good. In this ten-year chart, notice profits didn’t hit record highs during 2013-2015. At that time the company was investing in development that has enabled Fortinet to be the force it is today.

FTNT isn’t a flashy high-octane cyber stock like Zscaler, Crowdstrike or even Palo Alto Networks. But I do like how the company addresses different aspects of a business. It seems to me like the stock should be much higher. But I’m not anticipating FTNT will go on a big run higher as the stock has been weak during the COVID pandemic when many cyber stocks have raced higher. FTNT drops from 11th to 14th in the Conservative Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 14 of 34 |