Stock (Symbol)

|

Dollar General (DG)

|

Stock Price

|

$77

|

Sector

|

| Retail & Travel |

Data is as of

|

| December 10, 2016 |

Expected to Report

|

| Mar 8 – 13 |

Company Description

|

Dollar General Corporation offers a selection of merchandise, including consumables, seasonal, home products and apparel. Consumables category includes paper and cleaning products; packaged food; perishables; snacks; health and beauty; pet and tobacco products. Seasonal products include decorations, toys, batteries, small electronics, greeting cards, stationery, prepaid phones and accessories, gardening supplies, hardware, automotive and home office supplies. Home products includes kitchen supplies, cookware, small appliances, light bulbs, storage containers, frames, candles, craft supplies and kitchen, bed and bath soft goods. Apparel includes casual everyday apparel for infants, toddlers, girls, boys, women and men, as well as socks, underwear, disposable diapers, shoes and accessories. Its merchandise includes national brands and private brands selections. It operates approximately 11,879 stores located in over 43 states. Source: Thomson Financial Dollar General Corporation offers a selection of merchandise, including consumables, seasonal, home products and apparel. Consumables category includes paper and cleaning products; packaged food; perishables; snacks; health and beauty; pet and tobacco products. Seasonal products include decorations, toys, batteries, small electronics, greeting cards, stationery, prepaid phones and accessories, gardening supplies, hardware, automotive and home office supplies. Home products includes kitchen supplies, cookware, small appliances, light bulbs, storage containers, frames, candles, craft supplies and kitchen, bed and bath soft goods. Apparel includes casual everyday apparel for infants, toddlers, girls, boys, women and men, as well as socks, underwear, disposable diapers, shoes and accessories. Its merchandise includes national brands and private brands selections. It operates approximately 11,879 stores located in over 43 states. Source: Thomson Financial

|

Sharek’s Take

|

Dollar General (DG) stock is down because of heightened competition from Walmart, which had (has?) lower prices than Dollar General’s in some markets. The difference on many items was 10%, so this is a big deal. Dollar General management is addressing the problem by reducing prices, but this is bad in two ways as it lowers profit margins and they are already experiencing reduced traffic. To me, same store sales is the most important factor which determines a retail stock’s movement, and DG just reported qtrly SSS of 0% year-over-year. And for the 2nd straight qtr management lowered 2016 profit estimates, which have dropped from $4.64 to $4.49 and now $4.40. When you look past slow traffic, this company has a lot of good things. Management returns money to shareholders via acquisitions, dividends and big stock buybacks. Total store count went from 11,800 to 12,500 last year, and the company plans on adding 900 new stores this year and 1000 next year. DG’s also purchased 42 Walmart Express stores which opened as Dollar Generals this qtr. Management had a long-term goal of 11% to 17% total annual shareholder return through profit growth and dividends, but analysts have taken their Est. LTG down from 14% a year to 11% the past 2 qtrs. In the end, this is a solidly run company with good prospects for growth, but you have to sit through this slow period. I feel if we sell now, the stock will pop before you can get in. I kinda feel Dollar General will do better later in 2017, maybe come September when comparisons get easy. My 2017 Fair Value is 18x earnings or $85 a share. Dollar General (DG) stock is down because of heightened competition from Walmart, which had (has?) lower prices than Dollar General’s in some markets. The difference on many items was 10%, so this is a big deal. Dollar General management is addressing the problem by reducing prices, but this is bad in two ways as it lowers profit margins and they are already experiencing reduced traffic. To me, same store sales is the most important factor which determines a retail stock’s movement, and DG just reported qtrly SSS of 0% year-over-year. And for the 2nd straight qtr management lowered 2016 profit estimates, which have dropped from $4.64 to $4.49 and now $4.40. When you look past slow traffic, this company has a lot of good things. Management returns money to shareholders via acquisitions, dividends and big stock buybacks. Total store count went from 11,800 to 12,500 last year, and the company plans on adding 900 new stores this year and 1000 next year. DG’s also purchased 42 Walmart Express stores which opened as Dollar Generals this qtr. Management had a long-term goal of 11% to 17% total annual shareholder return through profit growth and dividends, but analysts have taken their Est. LTG down from 14% a year to 11% the past 2 qtrs. In the end, this is a solidly run company with good prospects for growth, but you have to sit through this slow period. I feel if we sell now, the stock will pop before you can get in. I kinda feel Dollar General will do better later in 2017, maybe come September when comparisons get easy. My 2017 Fair Value is 18x earnings or $85 a share. |

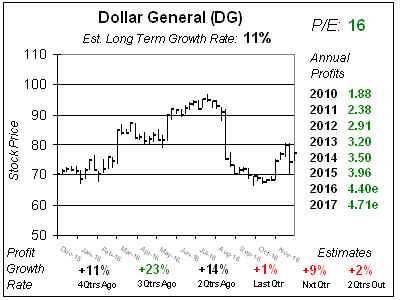

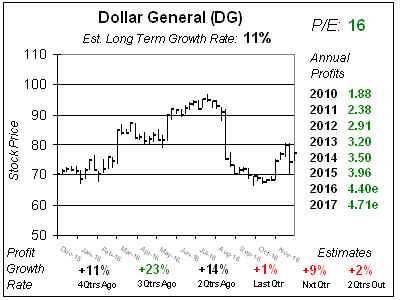

One Year Chart

|

This stock is a deal with a P/E of 16. But profits grew just 1% last qtr and missed the 6% estimate. Sales rose 5% which was decent. Notice how this stock crashed after missing by a penny and lowering guidance 2QtrsAgo — but then quickly jumped from $70 to $80 this past month. That’s why I think it’s best to just hang with DG, because you could miss a quick move. Estimates for future qtrs were just reduced for the 2nd straight qtr, and are now at 9%, 2%, 8% and 12%. This stock is a deal with a P/E of 16. But profits grew just 1% last qtr and missed the 6% estimate. Sales rose 5% which was decent. Notice how this stock crashed after missing by a penny and lowering guidance 2QtrsAgo — but then quickly jumped from $70 to $80 this past month. That’s why I think it’s best to just hang with DG, because you could miss a quick move. Estimates for future qtrs were just reduced for the 2nd straight qtr, and are now at 9%, 2%, 8% and 12%. |

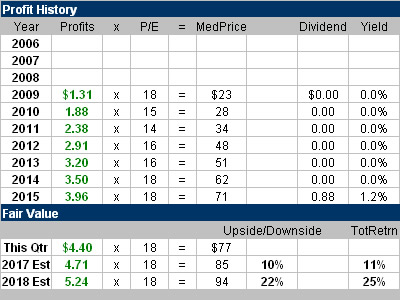

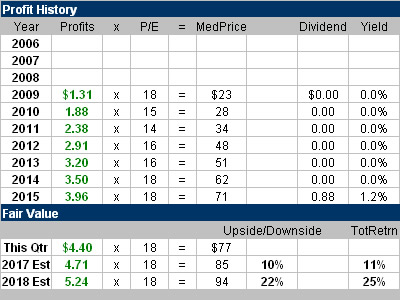

Fair Value

|

One of the reasons for Dollar General’s recent decline is when the stock was $95 two qtrs ago it had a P/E of 21. That was high. Now the valuation has gotten reasonable. The stock now sells for 18x earnings, which is what the median P/E was in 2014 & 2015. If profit estimates stay the same (they’ve been falling) and the stock continues to receive a 18 P/E there’s good potential during the next two years. But it remains to be seen if estimates can stop their slide. One of the reasons for Dollar General’s recent decline is when the stock was $95 two qtrs ago it had a P/E of 21. That was high. Now the valuation has gotten reasonable. The stock now sells for 18x earnings, which is what the median P/E was in 2014 & 2015. If profit estimates stay the same (they’ve been falling) and the stock continues to receive a 18 P/E there’s good potential during the next two years. But it remains to be seen if estimates can stop their slide. |

Bottom Line

|

Dollar General is experiencing sluggish sales, and management is pushing more promotions to combat this. As the ten-year chart shows, management has done a solid job running the company. DG has four great characteristics of a core holding. It grows via expansion, makes acquisitions, buys back stock, and pays a dividend. This is a good buy-and-hold stock for the conservative portion of investment accounts. DG ranks 28th in the Growth Portfolio Power Rankings and 8th in the Conservative Portfolio Power Rankings. Dollar General is experiencing sluggish sales, and management is pushing more promotions to combat this. As the ten-year chart shows, management has done a solid job running the company. DG has four great characteristics of a core holding. It grows via expansion, makes acquisitions, buys back stock, and pays a dividend. This is a good buy-and-hold stock for the conservative portion of investment accounts. DG ranks 28th in the Growth Portfolio Power Rankings and 8th in the Conservative Portfolio Power Rankings. |

Power Rankings

|

Growth Stock Portfolio

28 of 35

Aggressive Growth Portfolio

N/A

Conservative Stock Portfolio

10 of 29

|

Dollar General (DG) stock is down because of heightened competition from Walmart, which had (has?) lower prices than Dollar General’s in some markets. The difference on many items was 10%, so this is a big deal. Dollar General management is addressing the problem by reducing prices, but this is bad in two ways as it lowers profit margins and they are already experiencing reduced traffic. To me, same store sales is the most important factor which determines a retail stock’s movement, and DG just reported qtrly SSS of 0% year-over-year. And for the 2nd straight qtr management lowered 2016 profit estimates, which have dropped from $4.64 to $4.49 and now $4.40. When you look past slow traffic, this company has a lot of good things. Management returns money to shareholders via acquisitions, dividends and big stock buybacks. Total store count went from 11,800 to 12,500 last year, and the company plans on adding 900 new stores this year and 1000 next year. DG’s also purchased 42 Walmart Express stores which opened as Dollar Generals this qtr. Management had a long-term goal of 11% to 17% total annual shareholder return through profit growth and dividends, but analysts have taken their Est. LTG down from 14% a year to 11% the past 2 qtrs. In the end, this is a solidly run company with good prospects for growth, but you have to sit through this slow period. I feel if we sell now, the stock will pop before you can get in. I kinda feel Dollar General will do better later in 2017, maybe come September when comparisons get easy. My 2017 Fair Value is 18x earnings or $85 a share.

Dollar General (DG) stock is down because of heightened competition from Walmart, which had (has?) lower prices than Dollar General’s in some markets. The difference on many items was 10%, so this is a big deal. Dollar General management is addressing the problem by reducing prices, but this is bad in two ways as it lowers profit margins and they are already experiencing reduced traffic. To me, same store sales is the most important factor which determines a retail stock’s movement, and DG just reported qtrly SSS of 0% year-over-year. And for the 2nd straight qtr management lowered 2016 profit estimates, which have dropped from $4.64 to $4.49 and now $4.40. When you look past slow traffic, this company has a lot of good things. Management returns money to shareholders via acquisitions, dividends and big stock buybacks. Total store count went from 11,800 to 12,500 last year, and the company plans on adding 900 new stores this year and 1000 next year. DG’s also purchased 42 Walmart Express stores which opened as Dollar Generals this qtr. Management had a long-term goal of 11% to 17% total annual shareholder return through profit growth and dividends, but analysts have taken their Est. LTG down from 14% a year to 11% the past 2 qtrs. In the end, this is a solidly run company with good prospects for growth, but you have to sit through this slow period. I feel if we sell now, the stock will pop before you can get in. I kinda feel Dollar General will do better later in 2017, maybe come September when comparisons get easy. My 2017 Fair Value is 18x earnings or $85 a share.