Stock (Symbol) |

Becton Dickinson (BDX) |

Stock Price |

$253 |

Sector |

| Healthcare |

Data is as of |

| January 6, 2022 |

Expected to Report |

| February 3 |

Company Description |

BDX is a global medical technology company engaged in the development, manufacture and sale of a range of medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions, life science researchers, clinical laboratories. The Company operates through two segments: BD Medical and BD Life Sciences. Source: Thomson Financial BDX is a global medical technology company engaged in the development, manufacture and sale of a range of medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions, life science researchers, clinical laboratories. The Company operates through two segments: BD Medical and BD Life Sciences. Source: Thomson Financial |

Sharek’s Take |

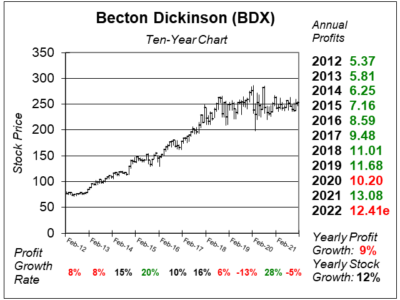

Medical supply company Becton, Dickinson (BDX) is a safe selection for 2022 as the stock market moves from favoring growth stocks to favoring value stocks. And BDX is the consumate value stock. The company is one of the world’s largest medical supply companies, manufacturing supplies that hospitals, clinics, and doctor offices require on a daily basis. This company had profits margins decline due to the COVID-19 pandemic. Now, business momentum is increasing and management sees margins increasing in 2022 and beyond. Medical supply company Becton, Dickinson (BDX) is a safe selection for 2022 as the stock market moves from favoring growth stocks to favoring value stocks. And BDX is the consumate value stock. The company is one of the world’s largest medical supply companies, manufacturing supplies that hospitals, clinics, and doctor offices require on a daily basis. This company had profits margins decline due to the COVID-19 pandemic. Now, business momentum is increasing and management sees margins increasing in 2022 and beyond.

Since 1897 Becton, Dickinson has manufactured syringes, catheters, lab equipment, diagnostic tests, and other disposable items for hospitals. The company has more than 70,000 associates serving greater than 190 countries worldwide. BD devices were used in ~90% of COVID-19 ICU patients in the U.S. with more than 1 billion COVID-19 vaccines delivered using BD’s injection devices. Becton, Dickinson has recently made two key acquisitions which have boosted profits. In 2016 BDX acquired CareFusion, a maker of precision drug dispensing equipment, gave Becton a shot of growth as it used BDX’s deep International network to sell fancy CareFusion products. Then in December 2017 Becton acquired C.R. Bard (BCR), a leader in catheters and stents. This merged two 100-year-old companies with long histories of providing medical equipment to hospitals. Both stocks were dependable 10% growers (Blue Chip stocks) with long histories of churning out growth. Becton Dickinson has three business segments:

BDX is an ultra-safe stock that I consider to be a 10% to 12% grower (stock growth + dividends). Analysts give the stock an Estimated Long Term Growth Rate of 9% per year and the stock yields just over 1%. Double digit growth with a safe stock isn’t appreciated enough in the investment world. The company grows organically and via acquisitions. It made 7 acquisitions in 2021. Fiscal 2021 was the company’s 50th consecutive year of dividend increases. Last qtr, management repurchased shares at a cost of $750 million. Becton Dickinson is a core holding in the Conservative Growth Portfolio. The stock has been basing for years, but could break out to new highs as money flows fom growth stocks to value stocks. |

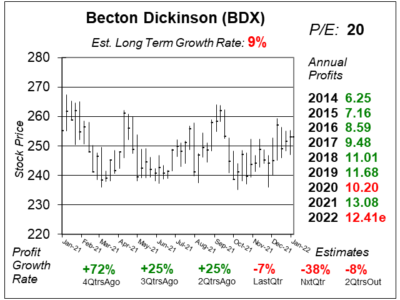

One Year Chart |

Note: these charts were done on January 6 when the stock was $253. Today, January 17, BDX is $263. The All-Time high is $264, and since money is moving into stocks like this, I expect BDX to be hittng new highs as soon as this week. With profits expected to decline the next two qtrs (and in 2022) I don’t see this stock as a buy if it breaks out. Maybe the stock can climb 10-15%. Note: these charts were done on January 6 when the stock was $253. Today, January 17, BDX is $263. The All-Time high is $264, and since money is moving into stocks like this, I expect BDX to be hittng new highs as soon as this week. With profits expected to decline the next two qtrs (and in 2022) I don’t see this stock as a buy if it breaks out. Maybe the stock can climb 10-15%.

The P/E of 20 is around where the P/E should be. The Est. LTG decreased from 10% last qtr to 9% this qtr. |

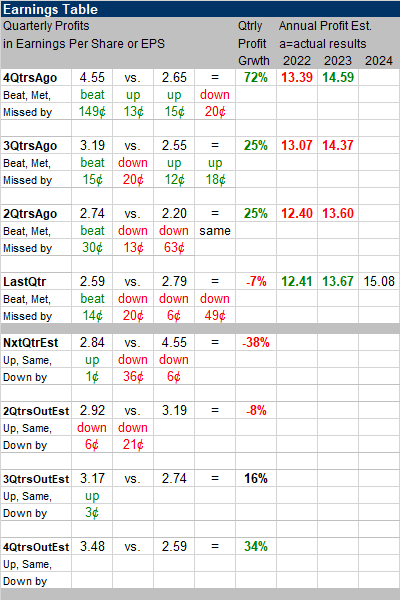

Earnings Table |

Last qtr, Becton Dickinson generated -7% profit growth, and beat estimates of -13%. Revenue increased 7%, year-on-year. Profits were lower than a year-ago due to lower COVID test pricing, higher shipping costs, and increased R&D. All three business segments delivered positive sales growth. Geographically, International drove higher sales success led by China and Latin America. Last qtr, Becton Dickinson generated -7% profit growth, and beat estimates of -13%. Revenue increased 7%, year-on-year. Profits were lower than a year-ago due to lower COVID test pricing, higher shipping costs, and increased R&D. All three business segments delivered positive sales growth. Geographically, International drove higher sales success led by China and Latin America.

The increase in sales was driven by sustained strong demand for catheters, vascular, infusion sets in the U.S., and strong demand for prefillable products Life Sciences growth was led by improved demand for specimen management products and research solutions, and growth in Interventional business, driven by recovering growth for biosurgery, infection prevention, hernia operations, atherectomy, oncology, and urology products. Annual Profit Estimates are similar to last qtr. Qtrly profit growth Estimates for the next 4 qtrs are -38%, -8%, 16%, and 34%. Management will spin-off two companies, RemainCo and NewCO, as well as higher inflation. |

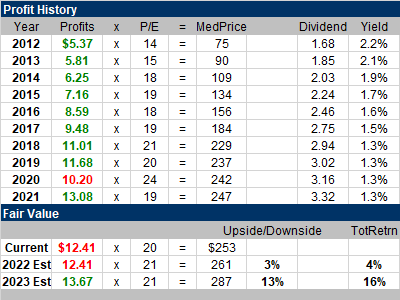

Fair Value |

My Fair Value P/E increased from 20 to 21 due to value stocks now attracting more investors. Still, that gives this stock just 3% upside for 2022 in this table. Note, the stock closed at $263 on Friday, so its essentially above my Fair Value now. My Fair Value P/E increased from 20 to 21 due to value stocks now attracting more investors. Still, that gives this stock just 3% upside for 2022 in this table. Note, the stock closed at $263 on Friday, so its essentially above my Fair Value now. |

Bottom Line |

Becton, Dickinson (BDX) is a true Blue Chip Stock with its medical products delivering a dependable revenue stream. The company has been in business for more than a century and has raised its dividend for 50 years. Becton, Dickinson (BDX) is a true Blue Chip Stock with its medical products delivering a dependable revenue stream. The company has been in business for more than a century and has raised its dividend for 50 years.

This stock has been basing since the beginning of 2018. But with the stock now within reach of an All-Time high and value stocks attracting assets, I think the stock will begin a new uptrend this qtr. BDX moves down 35th to 37th in the Conservative Portfolio Power Rankings. There’s not much upside here and the Est. LTG of 9% is nothing to get excited about. In addition, profits re expected to decline the next 2 qtrs. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 35 of 37 |