Stock (Symbol) |

Becton Dickinson (BDX) |

Stock Price |

$232 |

Sector |

| Healthcare |

Data is as of |

| March 12, 2020 |

Expected to Report |

| May 7 |

Company Description |

BDX is a global medical technology company engaged in the development, manufacture and sale of a range of medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions, life science researchers, clinical laboratories. The Company operates through two segments: BD Medical and BD Life Sciences. Source: Thomson Financial BDX is a global medical technology company engaged in the development, manufacture and sale of a range of medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions, life science researchers, clinical laboratories. The Company operates through two segments: BD Medical and BD Life Sciences. Source: Thomson Financial |

Sharek’s Take |

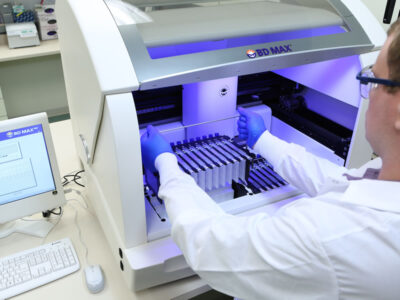

Medical supply company Becton Dickenson (BDX) has a device BD MAX that helps test for Coronavirus. The company is seeing 20% growth in its BD MAX, but this didn’t make a big impact company wide as the Life Sciences segment which accounted for 25% of company revenue, and had revenue growth of just 7% last qtr. Aside from BD MAX, Becton Dickinson has a plethora of products that assist health care. Medical supply company Becton Dickenson (BDX) has a device BD MAX that helps test for Coronavirus. The company is seeing 20% growth in its BD MAX, but this didn’t make a big impact company wide as the Life Sciences segment which accounted for 25% of company revenue, and had revenue growth of just 7% last qtr. Aside from BD MAX, Becton Dickinson has a plethora of products that assist health care.

Since 1897 Becton, Dickenson has manufactured syringes, catheters, lab equipment, diagnostic tests, and other disposable items for hospitals. Its business is steady, and honestly boring. The company has more than 65,000 associates serving greater than 190 countries around the world. During the last five years, BDX made two key acquisitions which have boosted profits. In 2016 BDX acquired CareFusion, a maker of precision drug dispensing equipment, gave Becton a shot of growth as it used BDX’s deep International network to sell fancy CareFusion products. In December 2017 Becton acquired C.R. Bard (BCR), a leader in catheters and stents and merged two 100-year-old companies with long histories of providing equipment to hospitals. Both stocks were dependable 10% growers with histories of growth dating back a century. Last qtr the company launched 11 new products, including a new catheter with a valve that makes the catheter easier to care for. Becton, Dickinson does make products in China, with 95% of those products sold and used in China. BDX is divided into three segments:

Becton Dickenson (BDX) is a safe, steady stock that’s increased its dividend for 48 consecutive years and has grown profits every year since 1999. This stock has grown 11% per year during the past decade, has an Estimated Long Term Growth Rate of 8% a year and a dividend yield of 1%. BDX is a true Blue Chip stock that is a core holding in the Conservative Growth Portfolio. |

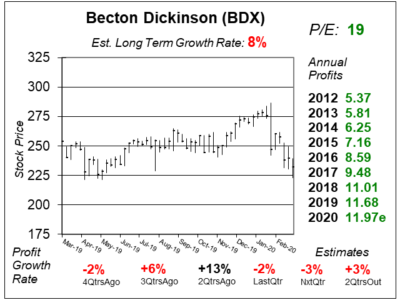

One Year Chart |

BDX has a situation with its Alaris, an infusion system with IV accessories and software to program infusions. The FDA recalled 774,000 Alaris devices due to system errors that resulted in 55 injuries and 1 death. This caused management to lower profit guidance. The FDA will have to accept software changes for BD to make new Alaris sales. The company lowered profit estimates on the news, and the stock sold off from $284 to $252 on heavy volume on February 6 (the day BDX reported earnings, cut guidance). BDX has a situation with its Alaris, an infusion system with IV accessories and software to program infusions. The FDA recalled 774,000 Alaris devices due to system errors that resulted in 55 injuries and 1 death. This caused management to lower profit guidance. The FDA will have to accept software changes for BD to make new Alaris sales. The company lowered profit estimates on the news, and the stock sold off from $284 to $252 on heavy volume on February 6 (the day BDX reported earnings, cut guidance).

The stock’s P/E has come down from 22 last qtr to 19 this qtr as the stock’s declined from $273 to $232. The Est. LTG of 8% is down from 10% last qtr and 11% 2QtrsAgo. |

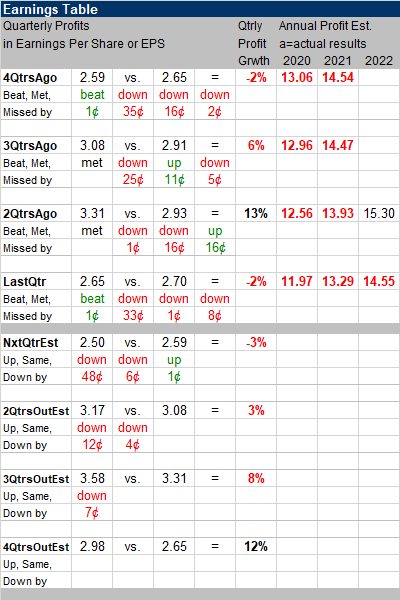

Earnings Table |

Last qtr, profit growth was -2% which beat estimates of -1%, but the company had previously lowered this estimate. Sales increased 2%. BD Medical revenue growth was -1%, BD Life Sciences had 7% growth, with BD Intervention achieving a 5% increase in revenue. Last qtr, the Life Sciences division benefited from the flu. Last qtr, profit growth was -2% which beat estimates of -1%, but the company had previously lowered this estimate. Sales increased 2%. BD Medical revenue growth was -1%, BD Life Sciences had 7% growth, with BD Intervention achieving a 5% increase in revenue. Last qtr, the Life Sciences division benefited from the flu.

Annual Profit Estimates declined for the 6th straight qtr. Qtrly Estimates are for -3%, 3%, 8% and 12% profit growth the next 4 qtrs. This factors in lower guidance due to Alaris. |

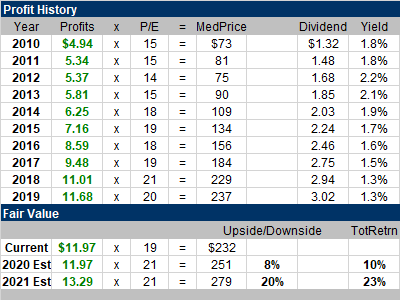

Fair Value |

My Fair Value P/E is getting reduced from 22 to 21. BDX was fairly valued last qtr, and this qtr has 8% upside in 2020, as well as 20% upside when we look to next year. My Fair Value P/E is getting reduced from 22 to 21. BDX was fairly valued last qtr, and this qtr has 8% upside in 2020, as well as 20% upside when we look to next year. |

Bottom Line |

Becton, Dickinson (BDX) is one of the worlds safest stocks, with its medical products delivering a dependable revenue stream. The company has been in business for more than a century and has raised its dividend for close to 50 years. Becton, Dickinson (BDX) is one of the worlds safest stocks, with its medical products delivering a dependable revenue stream. The company has been in business for more than a century and has raised its dividend for close to 50 years.

The company is having issues with its Alaris infusion system, and that matters more to the stock than the BD MAX, which is used for Coronavirus testing. BDX continues to rank 26th in the Conservative Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 26 of 33 |