About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

BDX is a global medical technology company engaged in the development, manufacture and sale of a range of medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions, life science researchers, clinical laboratories. The Company operates through two segments: BD Medical and BD Life Sciences. The Company’s Life Sciences segment consists of the BD Diagnostics and BD Biosciences segments. The Company’s BD Medical segment focuses on providing solutions to reduce the spread of infection, enhance diabetes treatment and advance drug delivery. The Company’s BD Diagnostics provides products for the safe collection and transport of diagnostics specimens, as well as instruments and reagent systems. Its BD Biosciences provide diagnostic and research tools to life science researchers, clinical researchers, laboratory professionals and clinicians. Source: Thomson Financial

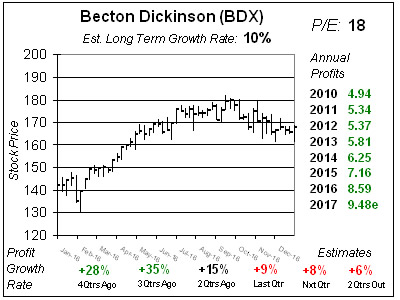

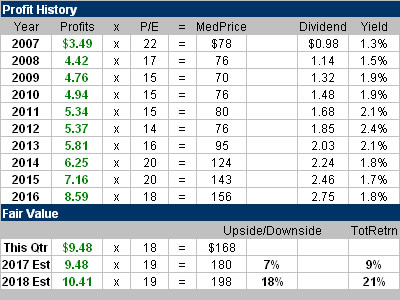

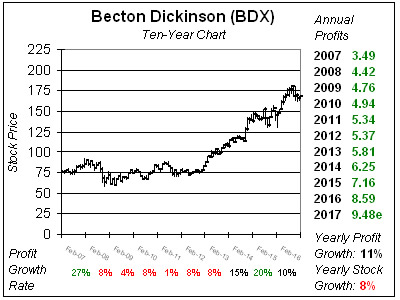

BDX is a global medical technology company engaged in the development, manufacture and sale of a range of medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions, life science researchers, clinical laboratories. The Company operates through two segments: BD Medical and BD Life Sciences. The Company’s Life Sciences segment consists of the BD Diagnostics and BD Biosciences segments. The Company’s BD Medical segment focuses on providing solutions to reduce the spread of infection, enhance diabetes treatment and advance drug delivery. The Company’s BD Diagnostics provides products for the safe collection and transport of diagnostics specimens, as well as instruments and reagent systems. Its BD Biosciences provide diagnostic and research tools to life science researchers, clinical researchers, laboratory professionals and clinicians. Source: Thomson Financial Becton, Dickinson (BDX) has manufactured syringes, catheters, lab equipment, diagnostic tests, and other disposable items for hospitals since 1897. What had been seen as a 8% to 10% grower, BDX kicked profit growth up a notch in 2015 when it acquired CareFusion, a maker of precision drug dispensing equipment. This merger boosted profit growth from around 10% to 20% in fiscal 2016 (year ending Sept 30th) as CareFusion gives Becton, Dickinson a more complete menu of medical products to hospitals. Additionally, Becton can also use its deep International network to sell CareFusion products, which in the past had just a limited presence abroad. But now that the merger is more than a year old, profit growth has returned to more normalized levels. Also, the company had been whipping earnings estimates, but only beat by a little last qtr. The slowdown in growth has taken the momentum out of this stock. BDX had a nice run from $150 to $180 during 2016, and has since has settled down to the $170 area. Still, Becton, Dickinson has grown profits every year going back to at least the year 2000, has an Estimated Long Term Growth Rate of 10% a year and a 2% yield. The dividend has increased every year since 1972. This is a nice safe stock for conservative investors.

Becton, Dickinson (BDX) has manufactured syringes, catheters, lab equipment, diagnostic tests, and other disposable items for hospitals since 1897. What had been seen as a 8% to 10% grower, BDX kicked profit growth up a notch in 2015 when it acquired CareFusion, a maker of precision drug dispensing equipment. This merger boosted profit growth from around 10% to 20% in fiscal 2016 (year ending Sept 30th) as CareFusion gives Becton, Dickinson a more complete menu of medical products to hospitals. Additionally, Becton can also use its deep International network to sell CareFusion products, which in the past had just a limited presence abroad. But now that the merger is more than a year old, profit growth has returned to more normalized levels. Also, the company had been whipping earnings estimates, but only beat by a little last qtr. The slowdown in growth has taken the momentum out of this stock. BDX had a nice run from $150 to $180 during 2016, and has since has settled down to the $170 area. Still, Becton, Dickinson has grown profits every year going back to at least the year 2000, has an Estimated Long Term Growth Rate of 10% a year and a 2% yield. The dividend has increased every year since 1972. This is a nice safe stock for conservative investors.