The stock market closed higher on Monday despite weak economic data from China, where interest rates were cut unexpectedly.

The stock market closed higher on Monday despite weak economic data from China, where interest rates were cut unexpectedly.

Overall, S&P500 increased 0.40% to 4,297, while NASDAQ was up 0.6% to 13,128.

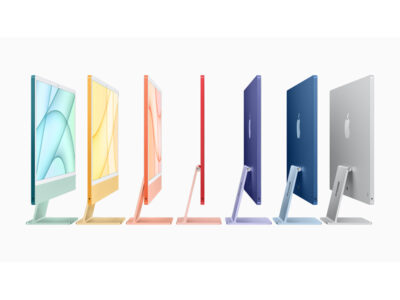

In the meantime, Apple (AAPL) was a sensation during the past decade. A lot of the growth came from the P/E rising.

Tweet of the Day

Aweeeee sookie sookie now now:

Greater than 90% of $SPX stocks are trading above their 50-DMA as of today.

Since 2003 n= 14 (including 2022)

Avg. 12-month returns = ~18%

Positivity rate = 94%$SPY $VIX $QQQ pic.twitter.com/jZtfQvYvAH— Seth Golden (@SethCL) August 12, 2022

Chart of the Day

Our chart of the day is AAPL’s one-year chart, done on May 1, 2013.

Our chart of the day is AAPL’s one-year chart, done on May 1, 2013.

Note that the stock was in a huge correction. But notice that profits (EPS) went from $2 to $44 in just six years. This stock was a long term leader.

With a P/E of only 10, this stock was also a bargain.

After splits, investors who bought in at that time and held would now have a cost basis of $16 on the stock. Apple closed at $173 today.

AAPL is part of the Conservative Growth Portfolio. The company was incredibly undervalued a decade ago. The stock’s median P/E was 12 to 13 during fiscal years 2011-2016, and then it was 16-17 during 2017-2019. In 2020, the median P/E jumped to 29. Looking ahead, I feel this stock is worthy of a 25 P/E, which equates to $154 this qtr.