Stock (Symbol) |

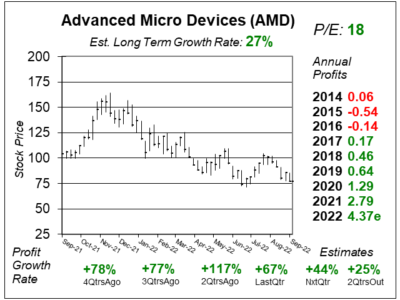

Advanced Micro Devices (AMD) |

Stock Price |

$77 |

Sector |

| Technology |

Data is as of |

| September 14, 2022 |

Expected to Report |

| October 24 |

Company Description |

Advanced Micro Devices, Inc. is a global semiconductor company. Its segments include Computing and Graphics, and Enterprise, Embedded and Semi-Custom. Advanced Micro Devices, Inc. is a global semiconductor company. Its segments include Computing and Graphics, and Enterprise, Embedded and Semi-Custom.

The Computing and Graphics segment primarily includes desktop and notebook microprocessors, accelerated processing units that integrate microprocessors and graphics, chipsets, discrete graphics processing units (GPUs), data center and professional GPUs, and development services. It may also sell or license portions of its intellectual property (IP) portfolio. The Enterprise, Embedded and Semi-Custom segment primarily includes server and embedded processors, semi-custom system-on-chip (SoC) products, development services, and technology for game consoles, and it may also sell or license portions of its IP portfolio. Its microprocessor customers consist primarily of original equipment manufacturers (OEMs), large public cloud service providers, original design manufacturers (ODMs), system integrators, and independent distributors. Source: Refinitiv |

Sharek’s Take |

Advanced Micro Devices (AMD) continues to deliver strong results even though the stock is close to 2-week lows. Last qtr AMD delivered 67% profit growth on 70% revenue growth. Advanced Micro Devices (AMD) continues to deliver strong results even though the stock is close to 2-week lows. Last qtr AMD delivered 67% profit growth on 70% revenue growth.

Advanced Micro Devices is a semiconductor company focused on high performance computing technology, software, and products. It develops high performance CPUs and GPUs and integrates these with hardware and software. CPUs are used for client systems, high performance computing, and cloud computing. GPUs are used for gaming, artificial intelligence, and virtual reality. The company has four business segments, here’s some info from last qtr:

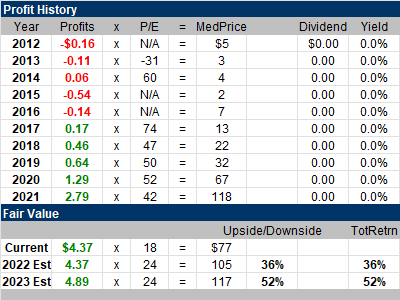

AMD has an above average Estimated Growth Rate of 27% a year, making this a potential selection for the Growth Portfolio. And the stock has a low P/E of 18, giving the shares good upside. My Fair Value is a P/E of 24. At a recent quote of $77, the stock has 36% and 52% upside to my 2022 & 2023 Fair Values of $105 and $117. Last qtr company had cash from operations of $1 billion and management spent $920 million on stock repurchases. |

One Year Chart |

This stock is in a severe downturn. Will it find support at $75 and move higher? That’s the big question. I’d like to buy the stock here, but the stock could head a lot lower if it breaks support. The stock market has been weak lately, and this recent rally count turn into a correction. If that happens, the weakest stocks will probably head to 52-week lows. This stock is in a severe downturn. Will it find support at $75 and move higher? That’s the big question. I’d like to buy the stock here, but the stock could head a lot lower if it breaks support. The stock market has been weak lately, and this recent rally count turn into a correction. If that happens, the weakest stocks will probably head to 52-week lows.

The P/E of 18 is nice and low. This stock is a value. The Est. LTG of 27% is very good for growth stock. These numbers look great. The chart pattern looks bad, and suggests the stock could head a lot lower. |

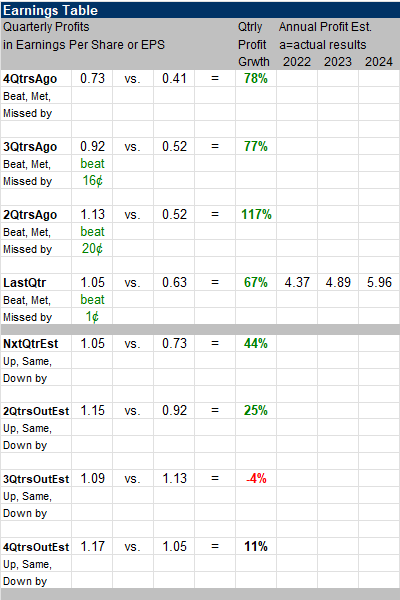

Earnings Table |

Last qtr, AMD delivered 67% profit growth and beat estimates of 65%. Revenue jumped 70%, but the company included Xilinx revenue last qtr, and that wasn’t there a year-ago. I looked for what Xilinx revenue was, to get a feel for whap organic growth, but management didn’t tell us (maybe I missed it somewhere). Last qtr, AMD delivered 67% profit growth and beat estimates of 65%. Revenue jumped 70%, but the company included Xilinx revenue last qtr, and that wasn’t there a year-ago. I looked for what Xilinx revenue was, to get a feel for whap organic growth, but management didn’t tell us (maybe I missed it somewhere).

Data Center revenue was lead by record server processor sales, with strong demand for Epyc processors from AWS, Baidu, Google, Microsoft Azure and Oracle. Client segment growth was lead by Acer, ASUS, Dell, HP and Lenovo on track to significantly expand AMD notebooks. In gaming, graphics cards declines but semi-custom growth more than offset this. The Embedded segment was mostly Xilinx products. This is my first qtr covering AMD, so I don’t have a handle on the movement of Annual Profit Estimates . Qtrly profit Estimates are for 44%, 25%, -4%, and 11% growth the next four qtrs. |

Fair Value |

My Fair Value is a P/E of 24, which equates to $105 a share. Note in the one-year chart above the stock hit a recent high of $105, then headed right back down. My Fair Value is a P/E of 24, which equates to $105 a share. Note in the one-year chart above the stock hit a recent high of $105, then headed right back down.

This stock seems to have excellent upside, but the semiconductor industry might worsen over the next year. It sure seems like that from looking at the stock charts. |

Bottom Line |

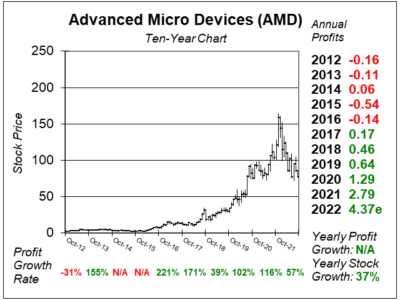

Advanced Micro Devices (AMD) has been growing profits nicely the past 5 years. But prior to that, the company had troubles. Prior to 2012, years that stick out profit-wise are a $0.70 profit in 2006 and a $2.89 profit in 2000. Advanced Micro Devices (AMD) has been growing profits nicely the past 5 years. But prior to that, the company had troubles. Prior to 2012, years that stick out profit-wise are a $0.70 profit in 2006 and a $2.89 profit in 2000.

AMD delivered great results last qtr, but a lot of that was due to the addition ot Xilinx to the portfolio. It’s uncertain what will happen during the next couple of qtrs as theeconomy is in a recession. This seems like a great buying opportunity, or this could be a suckers bet as the industry seems to be in poor health. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |