Stock (Symbol) |

Affirm (AFRM) |

Stock Price |

$135 |

Sector |

| Financial |

Data is as of |

| October 6, 2021 |

Expected to Report |

| November 9 |

Company Description |

Affirm Holdings, Inc., provides platform for digital and mobile commerce. Through its technology-driven payments network and partnership with an originating bank, it enables consumers to pay for a purchase over time. Through its platform, the consumer selects their repayment option, loans are funded and issued by its originating bank partner. Its platform includes three elements: a point-of-sale payment solution, merchant commerce solutions, and a consumer-focused application. Its point-of-sale solution allows consumers to pay for purchases in fixed. It enables consumers to pay overtime. Its platform enables APR payment options and interest-bearing loans. Its merchant commerce solutions allow merchants to solve for their customers. Its consumer-focused application enables consumers to use its application to manage payments, open a savings account and access a personalized marketplace. It provides a digital return experiences and post-purchase payments for direct-to-consumer brands. Source: Refinitiv Affirm Holdings, Inc., provides platform for digital and mobile commerce. Through its technology-driven payments network and partnership with an originating bank, it enables consumers to pay for a purchase over time. Through its platform, the consumer selects their repayment option, loans are funded and issued by its originating bank partner. Its platform includes three elements: a point-of-sale payment solution, merchant commerce solutions, and a consumer-focused application. Its point-of-sale solution allows consumers to pay for purchases in fixed. It enables consumers to pay overtime. Its platform enables APR payment options and interest-bearing loans. Its merchant commerce solutions allow merchants to solve for their customers. Its consumer-focused application enables consumers to use its application to manage payments, open a savings account and access a personalized marketplace. It provides a digital return experiences and post-purchase payments for direct-to-consumer brands. Source: Refinitiv |

Sharek’s Take |

Affirm (AFRM) is showing its strength in a stock market that’s in a correction, and with the news surrounding the company so overwhelmingly positive, this seems to be the top stock to own if the stock market begins to rally. Affirm is a financial platform that allows retailers to offer consumers an option to obtain goods now and pay at a later time (buy-now, pay-later). AFRM stock has been heavily accumulated the past three months as its more than doubled in price. But the hype might be real as the company has recently announced partnerships with Amazon, Walmart, Target and Shopify. With the buy-now, pay-later option just now gaining steam, this stock has enormous potential going into the Christmas season. Affirm (AFRM) is showing its strength in a stock market that’s in a correction, and with the news surrounding the company so overwhelmingly positive, this seems to be the top stock to own if the stock market begins to rally. Affirm is a financial platform that allows retailers to offer consumers an option to obtain goods now and pay at a later time (buy-now, pay-later). AFRM stock has been heavily accumulated the past three months as its more than doubled in price. But the hype might be real as the company has recently announced partnerships with Amazon, Walmart, Target and Shopify. With the buy-now, pay-later option just now gaining steam, this stock has enormous potential going into the Christmas season.

Affirm is a financial platform that allows retailers to offer consumers an option to obtain goods now and pay at a later time (buy-now, pay-later). As of June 30, 2021, over 10 million consumers and 29,000 merchants used its platform. AFRM processed over 7 million consumer purchases from a year ago. The company earns revenue from fees derived from merchants and interest income from consumers. Since Affirm’s founding in 2012, the company has charged $0 in late fees. Last fiscal year, AFRM the company completed the acquisition of Returnly, a returns platform tat allows the shopper to getthe right item before returning the wrong one, and Paybright, Canada’s leading buy-now, paylater (BNPL) solution. Affirm has been in the news recently for signing up retailers to its platform. Although the company already had an agreement with Shopify, last qtr Affirm strengthened the exclusive partnership with Shopify in their Shop Pay Installments in the U.S. Last August, the company announced the partnership with Amazon offering Affirm’s flexible payment solutions to consumers in the U.S. This allows consumers to split the cost of purchases in Amazon ranging from $50 or up into flexible monthly payments and without hidden charges and fees. This flexible payment offering is under testing and it will be out in the coming months. Yesterday, the stock soared more than 20% on news Target will be using the Affirm buy-now, pay-later platform as well. AFRM’s platform comprises of three core elements:

Here are some of stats from last qtr:

AFRM has ton of potential, as the stock is one of two leaders in the buy-now, pay-later space, the other being Afterpay which was recently acquired by Square. PayPal also jumped into the space, and is acquiring Paidy, a small Japanese company for $2.9 billion. Square acquired Afterpay for $29 billion. AFRM will be added to the Aggressive Growth Portfolio and Growth Portfolio today. |

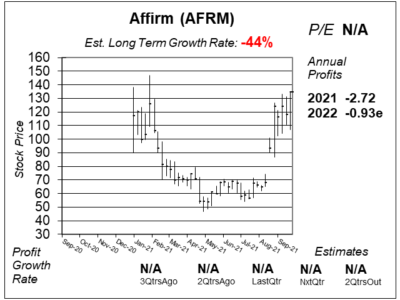

One Year Chart |

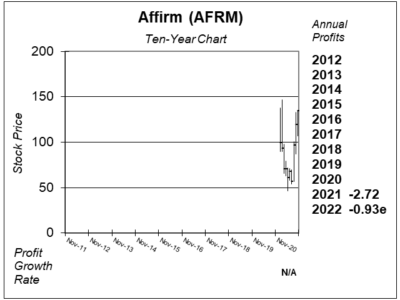

AFRM stock has been on a wild ride since the stock went public in January of this year, having gone from an opening price of $91 down to a low of $47 in May, and back up to $135. AFRM stock has been on a wild ride since the stock went public in January of this year, having gone from an opening price of $91 down to a low of $47 in May, and back up to $135.

There are no profits, and no profits on the horizon for this stock. AFRM has an Est. LTG rate of -44%. That seems strange. I would rather see nothing there than a negative number. The company doesn’t even have profits yet. |

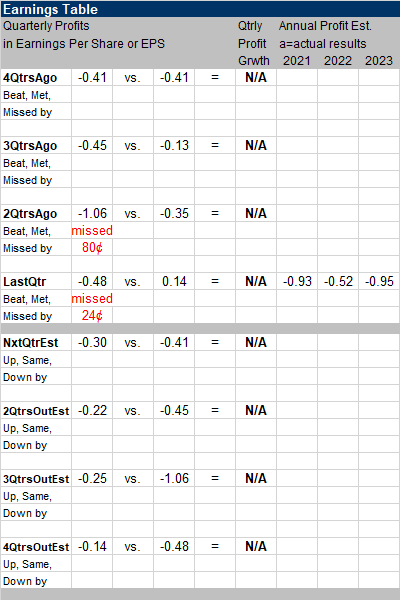

Earnings Table |

Last qtr, AFRM delivered $0.48 profit loss. Total revenue grew 71% while GMV jumped 106%. Last qtr, AFRM delivered $0.48 profit loss. Total revenue grew 71% while GMV jumped 106%.

The sales increase was driven by the 5 times growth in the number of merchants in the platform, more than double the growth in gross merchandise volume, and nearly double growth in the number of active consumers. This is my first qtr covering this stock, so I don’t have a trend on Annual Profit Estimates yet. I think we really have no idea what this company will make in the coming years. Will all these new retailers bring in a flood of new revenue, and perhaps a profit? Who knows. Qtrly Profit Estimates are for losses to continue for the foreseeable future. Management gave GMV guidance of around $3 billion (+70%) for next qtr and $13 billion (+50%) for 2022. Revenue is expected to reach around $250 million in the next qtr and $1 billion (+40%) in 2022. |

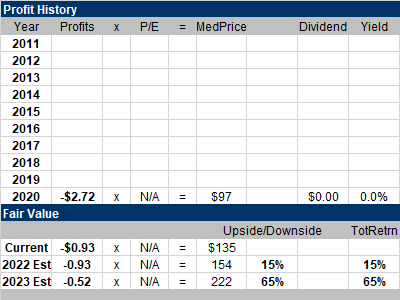

Fair Value |

Note, AFRM ended its Fiscal 2021 on June 30th. We are now in the 1st qtr of Fiscal 2022. My Fair Value is 35x annual revenue estimates: Note, AFRM ended its Fiscal 2021 on June 30th. We are now in the 1st qtr of Fiscal 2022. My Fair Value is 35x annual revenue estimates:

Current: 2022 Est. Fair Value 2023 Est. Fair Value |

Bottom Line |

Affirm (AFRM) has been on a wild ride this year, and now that the stock’s broken out it could be headed to higher places. Affirm (AFRM) has been on a wild ride this year, and now that the stock’s broken out it could be headed to higher places.

I feel this Christmas season will be fantastic for buy now, pay later. This segment is bound to blossom in the upcoming years. But a recession could cause defaults. The industry could hemorrhage like the mortgage industry did in the U.S. back in the early 2000s. But that’s a long way from here, so I will be bullish now. AFRM will be added to the Aggressive Growth Portfolio and rank 3rd in the Power Rankings. This is such a strong stock with oodles of potential that I will also add it to the Growth Portfolio where it will rank 13th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

13 of 34Aggressive Growth Portfolio 3 of 37Conservative Stock Portfolio N/A |