Stock (Symbol) |

Accenture (ACN) |

Stock Price |

$335 |

Sector |

| Technology |

Data is as of |

| January 25, 2022 |

Expected to Report |

| March 17 |

Company Description |

Accenture is a global professional services company with leading capabilities in digital, cloud, and security. Combining unmatched experience and specialized skills across more than 40 industries, they offer Strategy and Consulting, Interactive, Technology, and Operations services—all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. They currently employ 569,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. (Source: investor.accenture.com) Accenture is a global professional services company with leading capabilities in digital, cloud, and security. Combining unmatched experience and specialized skills across more than 40 industries, they offer Strategy and Consulting, Interactive, Technology, and Operations services—all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. They currently employ 569,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. (Source: investor.accenture.com) |

Sharek’s Take |

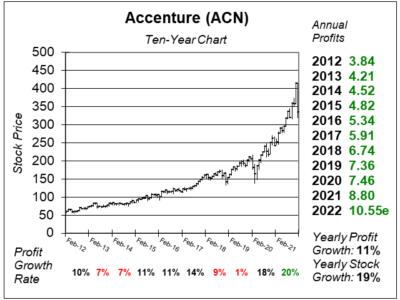

Consultant Accenture (ACN) has transformed itself from a slow-grower into a rapid-grower. Prior to 2021, ACN stock was considered to be a 10%-or-less profit grower. Since then, the company has molded into a digital consulting juggernaut via 46 acquisitions of $4.2 billion, $1.1 billion in R&D, and $900 million in management training — just during Fiscal 2021. Now, the company is growing sales and profits 20% or better. But with the recent NASDAQ selloff, ACN is down ~20% from its highs, and the stock looks like a safe bet to bounce back quickly. Consultant Accenture (ACN) has transformed itself from a slow-grower into a rapid-grower. Prior to 2021, ACN stock was considered to be a 10%-or-less profit grower. Since then, the company has molded into a digital consulting juggernaut via 46 acquisitions of $4.2 billion, $1.1 billion in R&D, and $900 million in management training — just during Fiscal 2021. Now, the company is growing sales and profits 20% or better. But with the recent NASDAQ selloff, ACN is down ~20% from its highs, and the stock looks like a safe bet to bounce back quickly.

Accenture, formerly Anderson Consulting, helps companies and organizations solve business challenges and transform their organizations. Employing more than 624,000 people, the company serves more than three-fourths of the Fortune Global 500. Enterprises use Accenture for Consulting on what to do, then utilize its Outsourcing divisions including finance, accounting, supply chain, marketing, and sales to get work done. Accenture’s Intelligent Platform is a combination of core platforms, cloud computing, the Internet of things, artificial intelligence, machine learning, and security. It uses platforms from companies including SAP, Oracle, Microsoft, Salesforce, Workday, and more. Accenture is a leading systems integrator for AWS, Azure, and Google Cloud. Management is investing substantially in its business making acquisitions in these hot areas to drive growth going forward. Its an early adapter of blockchain, robotics, 5G, quantum computing and Edge computing (source: 2021 Annual Report). Now, digital, cloud, and security services have been accounting for a majority of new bookings. Diamond clients are ACN’s largest relationships. The company added 15 new Diamond clients last qtr to bring the total to 244. It added 13 in all of Fiscal 2021. Last qtr stats include:

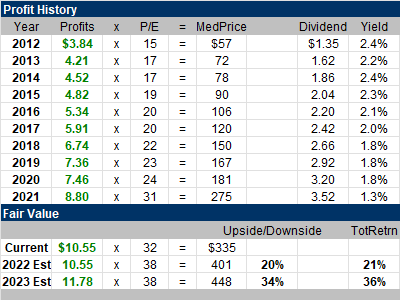

Accenture used to grow profits around 10% a year, and the stock had a P/E of 20 to 24. Now, ACN is growing profits +20% and the P/E is 32. I think the stock is deserving of a 38 P/E, and is undervalued by 20%. Also, 2022 profit estimates have risen from $9.38 to $10.55 the past four qtrs, so my projections might be low. In Fiscal 2021, management returned around $6 billion in cash and share repurchases to shareholders. Last qtr, management redeemed $845 million in shares and declared qtrly cash dividend of $0.97 per share to shareholders payable in February this year. ACN has been one of the hottest companies in the Conservative Growth Portfolio. With last qtr’s bookings growth (+30%) higher than revenue growth (27%) I think growth will accelerate in 2022. |

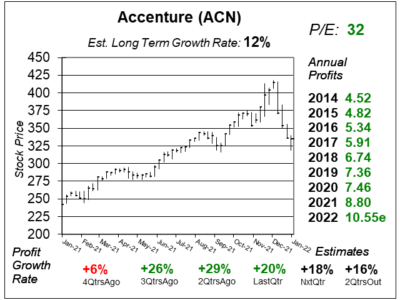

One Year Chart |

ACN was in a nice uptrend last qtr. This qtr, the stock has corrected. Around 50% of the NASDAQ stocks have fallen 50% from their highs. This one declined half that. Also, note the stock is hitting support here in the $300-$325 area. I think ACN is ripe to bounce back. ACN was in a nice uptrend last qtr. This qtr, the stock has corrected. Around 50% of the NASDAQ stocks have fallen 50% from their highs. This one declined half that. Also, note the stock is hitting support here in the $300-$325 area. I think ACN is ripe to bounce back.

The stock’s P/E fell from 36 last qtr to 32 this qtr. With bookings growth of 30%, revenue and/or profits might grow 30% in the coming qtrs. This stock seems like a bargain. Last qtr’s profit growth of 20% was outstanding, but profit growth was 11% in the same qtr a year ago (due to COVID-19) and comparisons were easy. The Est. LTG is 12%, same as last qtr. This seems too low, as management thinks revenue will gow 22% this year. |

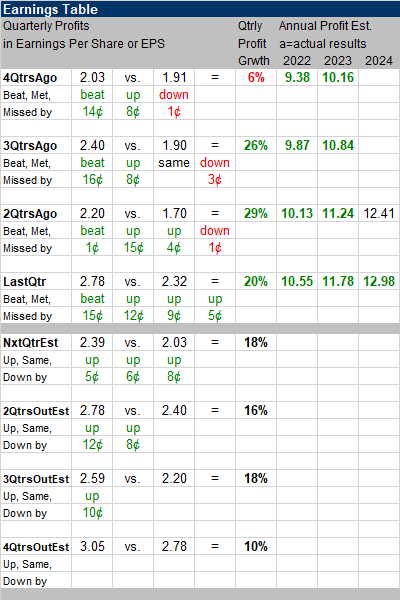

Earnings Table |

Last qtr, Accenture recorded 20% profit growth and beat estimates of 13% growth. Revenue increased 27%. New bookings achieved a record 30% growth. The European region had the strongest in sales growth. Last qtr, Accenture recorded 20% profit growth and beat estimates of 13% growth. Revenue increased 27%. New bookings achieved a record 30% growth. The European region had the strongest in sales growth.

Sales performance was enhanced by strong demand across Applied Intelligence, Cloud, Industry X, Interactive, Intelligent Operations, Intelligent Platform Services, Security, and transformational change management solutions, last qtr. Annual Profit Estimates have grown in each of the past five qtrs. Last qtr was ACN’s 1st in Fiscal 2022. For Fiscal 2022, management expects revenue to grow around 22%. Qtrly Profit Estimates are for 18%, 16%, 18%, and 10% profit growth the next 4 qtrs. Note the company has beaten the street in a big way in three of the last four qtrs. I think 20% profit growth will continue. Notice qtrly profit estimates have been rising every qtr. |

Fair Value |

This qtr, I keep my Fair Value P/E at 38. And according to my math, there’s 20% upside. Note 2022 profit estimates have risen from $9.38 to $10.55 the past four qtrs, so profits might come in better than we currently think. This qtr, I keep my Fair Value P/E at 38. And according to my math, there’s 20% upside. Note 2022 profit estimates have risen from $9.38 to $10.55 the past four qtrs, so profits might come in better than we currently think.

Also, ACN’s Fiscal Year end is August 31, so I will be looking ahead to 2023 estimates two qtrs from now. |

Bottom Line |

Accenture (ACN) was first named Anderson Consulting as it was the business and technology division of Arthur Anderson. Accenture was spun off as an IPO in 2001, and since then has gone from $15 to $335. Accenture (ACN) was first named Anderson Consulting as it was the business and technology division of Arthur Anderson. Accenture was spun off as an IPO in 2001, and since then has gone from $15 to $335.

Accenture has evolved into a leading consultant for companies looking to innovate in a new digital world. Revenue, profits, and bookings are growing +20% or greater. The company is rolling in the money, and uses its cash to buy other companies and buy back stock. ACN moves up from 16th to 6th in the Conservative Growth Portfolio Power Rankings. I will purchase the stock for the Growth Stock Portfolio, where it will rank 9th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

9 of 31Aggressive Growth Portfolio N/AConservative Stock Portfolio 17 of 37 |