Today in the stock market, Friday June 3, 2022, the stock market continued to deliver mixed signals to investors. Overall, the S&P 500 declined 1.6% to close at 4109 as the NASDAQ fell 2.5% to end the week at 12013.

The big question is “will we have a recession” and the stock market is often a great leading indicator to that. But the stock market is delivering mixed signals — down one day, up the next — and investors are caught in the middle. Pros and cons include:

- Stocks have aready gone through a HUGE correction. With many big name leaders selling for around 20x to 25x earnings, a fair price for leading stocks such as Alphabet (GOOGL) and Facebook (FB).

- The Stock Market isn’t low enough. The S&P 500 currently has a P/E of just over 17, which is a fair price for a “normal” market. But Bear Markets often end when the market’s P/E gets down to 14 or 15, which would cause the market to basically crash down to between 3250 and 3500.

- Inflation seems to be in decline. Used car prices hav been sliding for months and lumber prices fell 50% from their highs set in March.

- Food and Gasoline prices are still high. Gas prices hit a record $4.60 per gallon ahead of Memorial Day, and haven’t cooled off as government policies have restricted more US oil production. Food pries are remain high both at the gtrocery store and at restaurants.

Chart of the Day

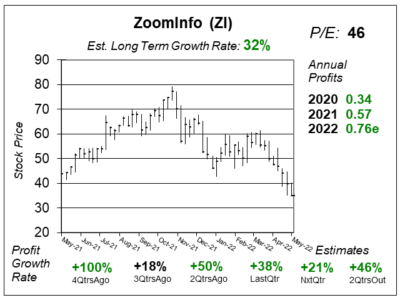

Our chart of the day is this one year chartr of ZoomInfo (ZI) created on May 4th when the stock was at $35. Today, ZI close at $41, so its bounced some. But that might be a dead cat bounce.

Our chart of the day is this one year chartr of ZoomInfo (ZI) created on May 4th when the stock was at $35. Today, ZI close at $41, so its bounced some. But that might be a dead cat bounce.

What’s bad about this chart is the stock seems to be free-falling lower. Even as profits are good. There’s a story behind this stock.

ZoomInfo’s cloud-based platform provides comprehensive sales and marketing information on organizations and professionals that work within them. This data is bought by large companies who can utilize the platform to make contact with others in the business world, i.e. make sales calls.

But how does the company get its data? Is it legally? That’s come into question by an equity research company, which put out a negative report on the stock, which you can read here.

But how does the company get its data? Is it legally? That’s come into question by an equity research company, which put out a negative report on the stock, which you can read here.

ZoomInfo seems to have some people who are short the stock, and who believe the data might have been obtained in unethical or illegal ways, such as data scraping LinkedIn.

Meanwhile, the company is delivering excellent results, and has signed up or extended deals with customers including Alphabet, Shopify and Hitachi.

ZI is part fo our Aggressive Growth Portfolio. I considered selling the stock this week, but decided to hold. This is a rapidly growing company that’s delivering solid profits, and the stock has a reasonable P/E. Still, I’m not a fan of controversy with a stock, and have been hurt in the past trying to hold a stock that was under this sort of pressure. ZI is a small holding for us, so I will continue to hold for the time being.

My Fair Value on ZoomInfo is 15x revenue, or $39 this year and $52 next year.