The Bear Market May Be Over

In the stock market today, the market went from being in a correction to entering a rally, as the S&P 500 rose 2% and the NASDAQ jumped 2.8%.

In the stock market today, the market went from being in a correction to entering a rally, as the S&P 500 rose 2% and the NASDAQ jumped 2.8%.

Investors.com changed the market outlook from correction to uptrend, the 2nd signal in the past few days that signal the Bear Market has ended. Here’s a recap of the key days that turned a downtrend into an uptrend:

- Thursday, May 5, 2022:

Downside Volume is 94% of the total volume on the NYSE. Over 90% down is a sign of capitulation. - Monday, May 9, 2022:

Downside Volume once again hit 94% on the NYSE, the 2nd capitulation day in a week. Now, we await a +90 upside day. - Wednesday May 11, 2022:

S&P 500 closes at 3935, below our Fair Value of 3955 for the 1st time in 2022. - Friday, May 13, 2022:

Market rally saw 92% of the stocks on the NYSE have Upside Volume on the day. This is a confirmation of intelligent investors snapping up what could be values of the decade. - Tuesday, May 17, 2022:

Stock market goes into confirmed uptrend with a follow through day to begin a new rally.

The key now is looking for a True Market Leader that can lead the stock market higher. Weeks ago, I felt the TML was Tesla (TSLA), but the stock has sagged lately. Now, I’m putting my bets on Broadcom (AVGO).

Chart of the Day

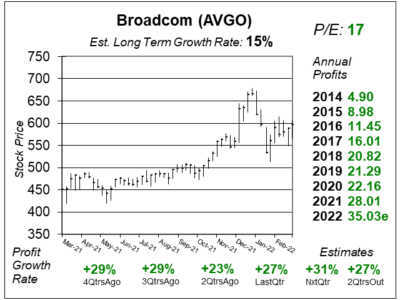

Our chart of the day is this one-year chart of Broadcom (AVGO) from March 6 (2022 Q1).

Our chart of the day is this one-year chart of Broadcom (AVGO) from March 6 (2022 Q1).

Broadcom is a semiconductor and software company that designs thousands of products for home connectivity, cloud data centers, and enterprise businesses. Broadcom is a conglomerate tat was formed over 50 years of mergers and acquisitions including old-school tech companies AT&T/Bell Labs, Hewlett-Packard, Lucent and the semiconductor division of Hewlett-Packard as well as younger industry leaders including Broadcom, LSI, Broadcom Corporation, Brocade, CA Technologies and Symantec.

AVGO is growing nicely and has a reasonable valuation. Profits have grown an average of 27% a qtr the past 4 qtrs, and estimates are for 29% growth on average the next 2 qtrs. The stock pays a healthy dividend of 3%, and the Estimated Long-Term-Growth Rate is 15%. Management even buys back stock.

AVGO closed at $608 today. My 2022 Fair Value is $701 (+15% upside) with 2023’s Fair Value at $766 (+26% upside). My Fair Value is only 20x earnings estimates. That’s cheap for a tech stock!

If AVGO has good earnings on June 2nd, I may up my Fair Value to a P/E of 24, which seems very fair considering profits have been growing 27%. 27 x $35 = $840 or 38% upside this year.