Today, Friday May 13, 2022, the stock market soared off of depresses levels as investors searched for bargains in the stock market.

Today, Friday May 13, 2022, the stock market soared off of depresses levels as investors searched for bargains in the stock market.

The NASDAQ composite was the big winner on the day as the index jumped 3.8%.

The S&P 500 jumped from 3930 on Thursday’s close to 4024 on Friday to close out the week. That’s a gain of 2.4%.

Our Fair Value on the S&P 500 is a P/E of 17 on 2022 earnings estimates, or 3955. So the market was essentially “fairly valued” on Thursday.

What’s good about that is the market isn’t overvalued anymore. Sure, the S&P 500 might get a P/E of 15 or 16, which would take the indexes lower, but then stocks would be “on sale”.

The 40-month moving average is another point of interest, as institutional investors might invest at that point. The 40-month moving-average on the S&P 500 is 3730. That’s 7% downside.

Stock Market Shows Signs of a Bottom

Today’s rally saw 92% of the stocks on the NYSE have Upside Volume on the day. That followed two 94% Downside Volume days within the past two weeks. This Upside Volume day could mark a new Bull Market, with buyers coming in to snatch up once-in-a-decade deals. Another 90% Upside Volume day would confirm this thesis, but a 90% Downside Day might mean the Bear Market Continues.

Chart of the Day

Chart of the Day

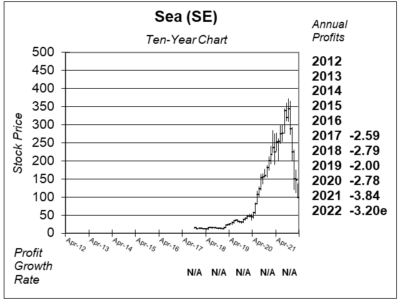

Speculative, or aggressive, growth stocks were the market leaders on the day: Ecommerce/Video Game/FinTech company Sea (SE) $61 jumped from $75 on no news. That was a rise of 23% on the day.

The company is set to report earnings next Tuesday, May 17.

SE hit an All-Time high of $367 in October 2021. Here’s the ten-year chart as of last qtr: