Today, April 29, 2022, the markets saw one of their worst days since this correction began in November 2021.

Today, April 29, 2022, the markets saw one of their worst days since this correction began in November 2021.

The S&P 500 declined 3.6% during today’s session while the NASDAQ dropped 4.2%.

The headline was shares of Amazon (AMZN) lost 14% on the day, to close at $2486. The company reported earnings yesterday that missed estimates and shocked investors (but didn’t shock us).

Amazon Falls Out of Bed After Earnings

Here’s AMZN’s results from last qtr:

- Profit: $7.38 vs. $15.79 = -53%

- Estimate: $8.50 vs. $15.79 = -46%

- Revenue: +7%

Honestly, Amazon was giving investors warning signals for a while.

In March of this year I sold all AMZN shares from client accounts after I read the Annual Report and saw Operating Income in North America (the retail side) fell from $8.7 billion in 2020 to $7.3 billion in 2021, while International fell from $717 million to -$924 million year-over-year.

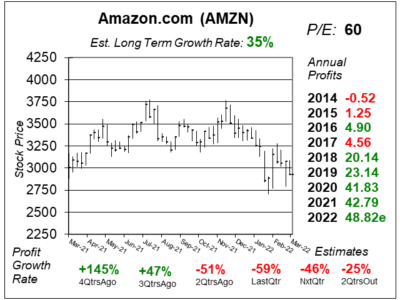

At the time I thought higher labor costs, higher raw material coss, and higher gasoline costs would take profits down even futher (and they did). Also, at the time, 2022 profit estimates had fallen from $72.09 to $48.82 during the past four qtrs.

So in a nutshell, Amazon’s retail business isn’t very profitable — and its unprofitable outside America. So Amazon Web Services is really carrying the company and its stock.

Today, AMZN’s 2022 profit estimate is $38.28. Recall it was $48.82 in March.

Chart of the Day

Chart of the Day

Our Chart of the day is last qtr’s Amazon one-year chart. Notice profit growth was slip-sliding away two qtrs ago. The stock was also in a steep decline. And with a P/E of 60, the shares were expensive.

What should investors do now? I do like the long-term appeal of this company.

It seems management overhired and overbuilt expecting more retail demand. But post-COVID, people are going out to shops more. Thus, the company might have to lay some people off. And it could cut back on construction, which would lower expenses.

But in the near-term, we are in a Bear Market and this stock has little certainty as it just missed earnings estimates and annual profit estimates just declined for the 5th consecutive qtr.

My guess is the stock could decline until the P/E gets to 45. With 2022 profit estimates now $38.28 that’s 45 x $38.28 = $1773 a share.