Today, April 20, 2022, although the S&P 500 was flat on the day (-0.01%) the NASDAQ was down 1% as stocks continued to perform as they have since last November. The current trend is:

- Conservative stocks showed strength. Of the 35 stocks in our Conservative Growth Portfolio, 26 were up on the day.

- Growth stocks had a big loser. Shares of Netflix (NFLX) declined a whopping 35% on the day to close at $226.

- Aggressive Growth Stocks fell hard. Within this set of stocks:

Upstart (UPST) declined 9% to $80

Cloudflare (NET) dropped 7% to $104

Hubspot (HUBS) fell 6% to $426 and

Snowflake (SNOW) was down 6% to $186.

Netflix Tanks 35% After Dismal Earnings

Netflix Tanks 35% After Dismal Earnings

Yesterday, Netflix (NFLX) reported earnings after the market closed. The big number was the company lost 200,000 subscribers during the qtr versus estimates of 2.5 million new subscribers. The company left the Russian market this qtr, and management stated if it weren’t for that it would have added 500,000 subs.

Still, it feels like NFLX is having a COVID-19 hangover as people get outside again. Management also mentioned many families are sharing one subscription amongst multiple households, and that’s hurting potential revenue. Still, Netflix needs a new catalyst.

Other than Netflix and aggressive growth stocks, Disney (DIS) declined 6% as it is set to lose some tax advantages the Florida goverment is repealing. Namely, the company was getting tax breaks for overseeing some public services on its own land, such as maintaining its own roads and bridges.

Chart of the Day

Chart of the Day

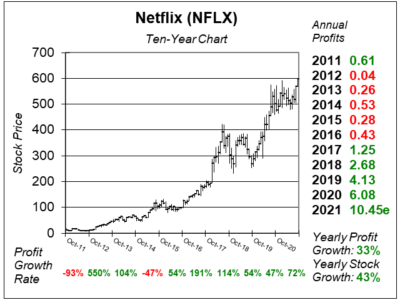

Today’s chart of the day is this beautiful ten-year chart of Netflix from 2021 Q3. During this ten-year timeframe the stock went from $34 to $597.

What’s interesting about this is that a decade earlier I added NFLX to all client accounts ~$30. Here’s the old research report. Still, the purchase wasn’t a success initially as shortly after I purchased, the stock fell to ~$20.