In the stock market today, Monday, May 16, 2022, stocks were mostly lower after a HUGE up day on Friday. The S&P 500 finished the day with a -0.4% return as the NASDAQ composite delivered a -1.2% return.

In the stock market today, Monday, May 16, 2022, stocks were mostly lower after a HUGE up day on Friday. The S&P 500 finished the day with a -0.4% return as the NASDAQ composite delivered a -1.2% return.

Weakness was seen in low-profit, high price-to-sales stocks, including:

- Zscaler (ZS): -9% to $140

- Cloudflare (NET): -14% to $57

- MongoDB (MDB): -12% to $252

- Datadog (DDOG): -11% to $97

- Bill.com (BILL): -8% to $109

- Snowflake (SNOW): -9% to $144

The stock market is trying to rally here, but further weakness could signal a recession is in play, which could bring the indexes down further. These high-multiple stocks above could continue to free-fall if the market were to head to new lows.

Chart of the Day

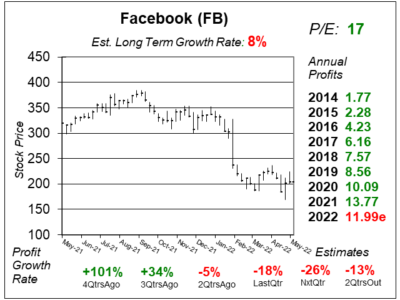

Our chart of the day is this one-year chart of Meta (FB).

Our chart of the day is this one-year chart of Meta (FB).

If the stock were to jump up on high volume on a confirmation that spending on the Metaverse will slow I might be inclined to buy.

For now, it seems Mark Zuckerberg is spending money like a drunken sailor at a crowded bar. Revenue grew 7% last qtr while total costs and expenses jumped 31%. Within the Reality Labs segment, revenue was $700 million while expenses were $3.7 billion. So Reality Labs lost $3 billion last qtr.

Two catalysts that could send the stock higher are (1) less spend on the Metaverse and (2) if Meta can get past Apple’s ad data blocking, it would make it easier for advertisers to gain analytics, and thus profit more from advertising on Facebook and Instagram.

FB is not owned in client accounts at this time, I have it on the radar for the Growth Portfoli0.