Express Scripts Expects To Lose Anthem’s Business

Express Scripts (ESRX) expects to lose its business customer Anthem. But with ESRX down so much, it’s selling for just 9 times earnings. Is it a value?

Express Scripts (ESRX) expects to lose its business customer Anthem. But with ESRX down so much, it’s selling for just 9 times earnings. Is it a value?

Lowering drug prices is big in the news, and that’s hampering stocks like Express Scripts (ESRX). But with ESRX at its lows, is this the time to sell?

Express Scripts (ESRX) is one drug distributor which didn’t lower earnings estimates last qtr. At 11x earnings the stock is a value, but does come with risk.

Express Scripts (ESRX) has its issues, such as uncertainty with its largest customer and political pressure for lower drug prices. But at 11 times earnings, ESRX is a value.

Express Scripts (ESRX) is looking good on the profit front. But investors are overly skittish about the possibility of it losing its biggest customer.

Express Scripts (ESRX) fell after its largest client, Anthem, said it wanted $3 billion in better drug prices. Let’s talk about it.

Express Scripts (ESRX) gets my highest mark for certainty and consistency, and management just upped 2016 profit estimates.

Investors looking for conservative double-digit returns should take a look at Express Scripts (ESRX), but growth investors might want faster growth.

Express Scripts (ESRX) is expected to grow 13% — both in the next year and beyond.

Express Scripts (ESRX) is expected to have 11% profit growth every quarter this year.

Express Scripts (ESRX) is Old Dependable in my client’s portfolios. Here’s my outlook on ESRX for 2015.

Express Scripts (ESRX) should have higher profit growth later this year, but don’t get too excited about ESRX.

Bad weather and new clients delaying deals caused Express Scripts (ESRX) to miss last quarter, but things will get better.

Express Scripts (ESRX) should grow profits around 20% this year, but that news has taken up shares of ESRX, limiting its upside.

Express Scripts (ESRX) isn’t growing sales, but profits keep climbing due to management’s big buyback of ESRX shares.

Express Scripts (ESRX) will likely have slow profit growth — and stock growth — the next two quarters. Still, ESRX is good for long-term investors.

Shares of Express Scripts (ESRX) aren’t as discounted as they were six months ago, but the stock still has solid upside for long term thinkers.

Shares of Express Scripts (ESRX) are on the comeback trail. Although growth might simmer some, ESRX is cheap and has momentum.

Express Scripts (ESRX) is the perfect blend of certainty, consistency and growth opportunity — and its tremendously undervalued.

Express Scripts (ESRX) is a conservative stock with little downside risk that is tremendously undervalued right now. ESRX is one of my top picks for 2013.

Express Scripts (ESRX) has gone from having major issues three quarters ago to clicking on all cylinders this quarter. ESRX is going higher.

Express Scripts (ESRX) is merging with Medco (MHS) and the deal could be completed this quarter. Synergies could produce better-than-expected profits.

Express Scripts (ESRX) was down-for-the-count last October when it was trading around $40. Now the stock is over $50 and has staged a miraculous recovery.

Shares of Express Scripts (ESRX) are selling at only 14 times earnings. Meanwhile profit growth is expected to average 32% during the next four quarters. If you think we are headed for a recession, then ESRX might be for you.

Express Scripts (ESRX) it hitting all-time highs today. The long-term outlook continues to be solid thanks to one word: Generics.

Express Scripts (ESRX) has great numbers and a safe, solid business. Its also undervalued and has solid upside. I love this stock for the long-run, its just not going anywhere right now.

With Express Scripts (ESRX) you know what you’re getting. Steady profit growth and a low P/E. The stock’s also formed a cup-and-handle. Here’s where I think the stock goes if it breaks out.

Express Scripts (ESRX) moves up in the Power Rankings as the stock market has just started a correction.

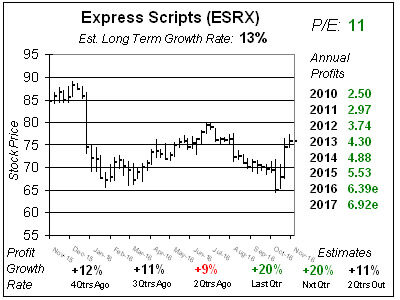

Left: ESRX’s ten-year chart shows the stock has been a solid investment during the last decade.