About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

Stryker Corporation (Stryker) is a medical technology company. The Company operates through three segments: Orthopaedics, MedSurg, and Neurotechnology and Spine. The Company’s Orthopaedics segment products consist of implants used in hip and knee joint replacements and trauma and surgeries. The Company’s MedSurg segment products consist of surgical equipment and surgical navigation systems (Instruments); endoscopic and communications systems (Endoscopy); patient handling and emergency medical equipment (Medical), and reprocessed and remanufactured medical devices (Sustainability), as well as other medical device products used in a range of medical specialties. The Company’s Neurotechnology and Spine segment products consist of both neurosurgical and neurovascular devices. The Company’s products are sold in approximately 100 countries through the Company-owned sales subsidiaries and branches, as well as third-party dealers and distributors. Source: Thomson Financial

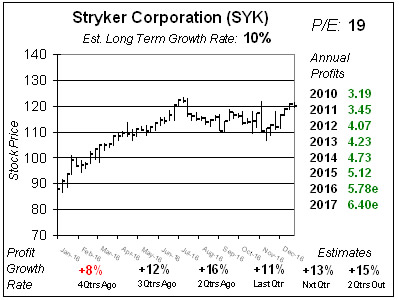

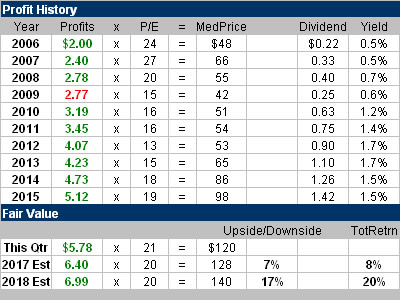

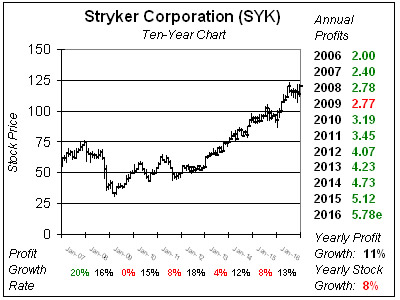

Stryker Corporation (Stryker) is a medical technology company. The Company operates through three segments: Orthopaedics, MedSurg, and Neurotechnology and Spine. The Company’s Orthopaedics segment products consist of implants used in hip and knee joint replacements and trauma and surgeries. The Company’s MedSurg segment products consist of surgical equipment and surgical navigation systems (Instruments); endoscopic and communications systems (Endoscopy); patient handling and emergency medical equipment (Medical), and reprocessed and remanufactured medical devices (Sustainability), as well as other medical device products used in a range of medical specialties. The Company’s Neurotechnology and Spine segment products consist of both neurosurgical and neurovascular devices. The Company’s products are sold in approximately 100 countries through the Company-owned sales subsidiaries and branches, as well as third-party dealers and distributors. Source: Thomson Financial Stryker develops orthopedic implants, surgical equipment, neurotechnology and spine products. Stryker has compiled 37 straight years of record sales growth and is cash rich. The company uses its money wisely. It buys back stock, pay a dividend, and make acquisitions — I love three-pronged attacks like this. It’s had dividend growth of 15% per year since 2012.

Stryker develops orthopedic implants, surgical equipment, neurotechnology and spine products. Stryker has compiled 37 straight years of record sales growth and is cash rich. The company uses its money wisely. It buys back stock, pay a dividend, and make acquisitions — I love three-pronged attacks like this. It’s had dividend growth of 15% per year since 2012.