About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

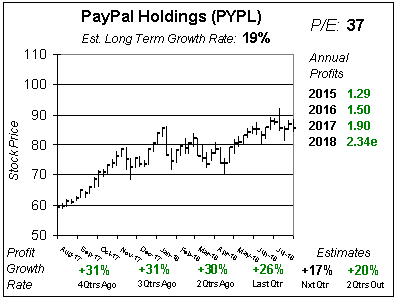

PayPal (PYPL) is delivering impressive results, but profit growth just slowed from 30% to 26% last qtr, and I feel it will be 22%-24% this qtr. Here’s a few bullet points from last qtr:

PayPal (PYPL) is delivering impressive results, but profit growth just slowed from 30% to 26% last qtr, and I feel it will be 22%-24% this qtr. Here’s a few bullet points from last qtr:

PYPL tried to break out recently, but with slowing results it came back down. The Last qtr the company beat the street by 2 cents. It had previously beaten by 3 cents in each of the last 5 qtrs. Qtrly profit Estimates are 17%,

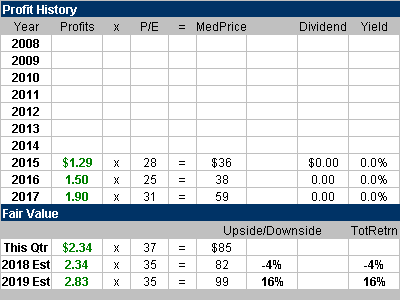

PYPL tried to break out recently, but with slowing results it came back down. The Last qtr the company beat the street by 2 cents. It had previously beaten by 3 cents in each of the last 5 qtrs. Qtrly profit Estimates are 17%,  2018 estimates stayed the same this qtr. I don’t think a stock can get great momentum if annual estimates aren’t rising. My Fair Value P/E is getting cut a little this qtr, from 37 to 35. Last qrt my Fair Value was a stock price of $87 and I pretty much hit that on the head. This qtr it’s $82.

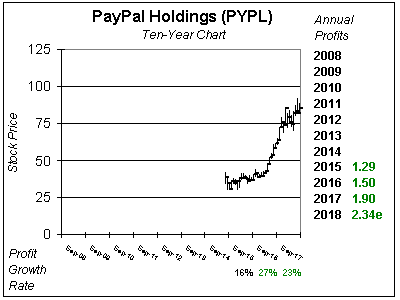

2018 estimates stayed the same this qtr. I don’t think a stock can get great momentum if annual estimates aren’t rising. My Fair Value P/E is getting cut a little this qtr, from 37 to 35. Last qrt my Fair Value was a stock price of $87 and I pretty much hit that on the head. This qtr it’s $82. PayPal continues to drive results higher as people are using their phone more and more to make purchases and send money. The stock’s been a good one since its IPO, but has had periods where it didn’t move much. I feel this is one of those times, and am not bullish on the shares at this time. This is still a solid buy-and-hold name with great growth opportunity, so I wouldn’t suggest selling out unless you have an itchy trigger finger that’s looking for immediate gratification. PYPL is ranked 30th in the

PayPal continues to drive results higher as people are using their phone more and more to make purchases and send money. The stock’s been a good one since its IPO, but has had periods where it didn’t move much. I feel this is one of those times, and am not bullish on the shares at this time. This is still a solid buy-and-hold name with great growth opportunity, so I wouldn’t suggest selling out unless you have an itchy trigger finger that’s looking for immediate gratification. PYPL is ranked 30th in the