Stock (Symbol) |

NVIDIA (NVDA) |

Stock Price |

$224 |

Sector |

| Retail & Travel |

Data is as of |

| January 11, 2018 |

Expected to Report |

| Feb 7 |

Company Description |

Nvidia Corporation focuses on personal computer (PC) graphics, graphics processing unit (GPU) and also on artificial intelligence (AI). The Company’s operates through two segments: GPU and Tegra Processor. The Company’s GPU product brands are aimed at specialized markets, including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users. The Company’s Tegra brand integrates an entire computer onto a single chip, and incorporates GPUs and multi-core central processing units (CPUs) to drive supercomputing for mobile gaming and entertainment devices, as well as autonomous robots, drones and cars. Source: Thomson Financial Nvidia Corporation focuses on personal computer (PC) graphics, graphics processing unit (GPU) and also on artificial intelligence (AI). The Company’s operates through two segments: GPU and Tegra Processor. The Company’s GPU product brands are aimed at specialized markets, including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users. The Company’s Tegra brand integrates an entire computer onto a single chip, and incorporates GPUs and multi-core central processing units (CPUs) to drive supercomputing for mobile gaming and entertainment devices, as well as autonomous robots, drones and cars. Source: Thomson Financial |

Sharek’s Take |

NVIDIA (NVDA) is taking over the world, as it’s the brains behind the new generation of computers. NVIDIA’s chipsets and processors are perhaps two years ahead of the competition. And with technology moving so fast, their lead is breathtaking. Here’s NVDA’s five divisions. NVIDIA (NVDA) is taking over the world, as it’s the brains behind the new generation of computers. NVIDIA’s chipsets and processors are perhaps two years ahead of the competition. And with technology moving so fast, their lead is breathtaking. Here’s NVDA’s five divisions.

NVIDIA is really the brains of the new AI economy with virtual reality and electronic cars. These high production computer chips are needed to mine crypto-currencies like Bitcoin, which is a worldwide phenomenon. In countries outside the U.S. people are buying state-of-the-art computers to search for or mine for coins. The only problem with NVDA stock is it’s up ten-fold in two years. It sells for around 50x earnings and grew profits 35% last qtr with profit Estimates for the next 4 qtrs of 16%, 23%, 16% and -3%. And it’s technically a semiconductor stock, which have little consistency and thus low certainty. Obviously I’m wrong, and I’ve missed out on a ten-bagger (and used to own the stock many years ago). NVDA is at the top of my radar. I’m dying to buy, and have been waiting for an opportunity since $150. |

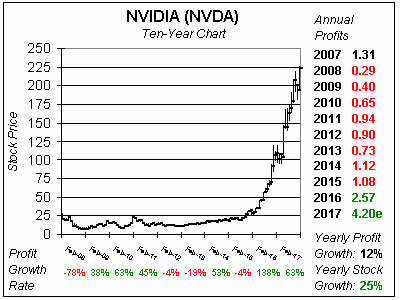

One Year Chart |

What I mean by little consistency is profits used to be up-and-down in years past. Notice the red Annual Profit figures to the right. In my book, anytime a stock doesn’t hit a record high in annual profit growth, I highlight the figure in red. Then poof, profits soared in 2016 and 2017. Now 2018 profits are expected to climb just 12%. But profit estimates have been soaring, so what do you believe? Est. LTG of 15% a year is quite low. What I mean by little consistency is profits used to be up-and-down in years past. Notice the red Annual Profit figures to the right. In my book, anytime a stock doesn’t hit a record high in annual profit growth, I highlight the figure in red. Then poof, profits soared in 2016 and 2017. Now 2018 profits are expected to climb just 12%. But profit estimates have been soaring, so what do you believe? Est. LTG of 15% a year is quite low. |

Fair Value |

My Fair Value on NVDA stock is 45x earnings, which is $212 and the stock’s blown past that mark. Notice how this stock had a P/E in the 20s in 2015 and 2016. My Fair Value on NVDA stock is 45x earnings, which is $212 and the stock’s blown past that mark. Notice how this stock had a P/E in the 20s in 2015 and 2016. |

Bottom Line |

It’s just hard to fathom almost a ten-fold move without a serious correction. But NVDA is doing that. This chart shows an extended stock, yet investors must be looking ahead for something bigger. I have NVDA at the top of my radar and feel if the stock market corrects this stock could give us an excellent buying opportunity. But I said that around 50% ago too. It’s just hard to fathom almost a ten-fold move without a serious correction. But NVDA is doing that. This chart shows an extended stock, yet investors must be looking ahead for something bigger. I have NVDA at the top of my radar and feel if the stock market corrects this stock could give us an excellent buying opportunity. But I said that around 50% ago too. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |