Stock (Symbol) |

Microsoft (MSFT) |

Stock Price |

$394 |

Sector |

| Technology |

Data is as of |

| February 5, 2026 |

Expected to Report |

| April 28 |

Company Description |

Microsoft Corporation develops and supports software, services, devices, and solutions. Its segments include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Microsoft Corporation develops and supports software, services, devices, and solutions. Its segments include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing.

The Productivity and Business Processes segment consists of products and services in its portfolio of productivity, communication, and information services, spanning a variety of devices and platforms. This segment includes Office Consumer, LinkedIn, dynamics business solutions, and Office Commercial. The Intelligent Cloud segment consists of public, private, and hybrid server products and cloud services that can power modern businesses and developers. This segment includes server products and cloud services, and enterprise services. The More Personal Computing segment consists of products and services that put customers at the center of the experience with its technology. This segment includes Windows, devices, gaming, and search and news advertising. Source: Refinitiv |

Sharek’s Take |

Microsoft (MSFT) beat estimates and delivered a strong 28% profit growth on a 17% increase in revenues last quarter. Profits were expected to grow 23% so I was happy with the beat. This was mainly driven by both Microsoft Cloud and Azure which posted 26% and 39% year-on-year growth, respectively. Microsoft Cloud breached the $50 billion mark last quarter, supported by strong demand for AI-powered cloud services. On the other hand, Azure and related services, saw robust demand as enterprises expanded usage of compute and AI workloads. Although Microsoft had a strong quarter, the stock moderately declined amid concerns on heavy AI capital spending as well as Azure’s strong (+39% sales growth) but lower-than-expected performance. However, management said they could have done more Azure business if they needed to, but instead took some Azure chips and put them into its core business. Microsoft (MSFT) beat estimates and delivered a strong 28% profit growth on a 17% increase in revenues last quarter. Profits were expected to grow 23% so I was happy with the beat. This was mainly driven by both Microsoft Cloud and Azure which posted 26% and 39% year-on-year growth, respectively. Microsoft Cloud breached the $50 billion mark last quarter, supported by strong demand for AI-powered cloud services. On the other hand, Azure and related services, saw robust demand as enterprises expanded usage of compute and AI workloads. Although Microsoft had a strong quarter, the stock moderately declined amid concerns on heavy AI capital spending as well as Azure’s strong (+39% sales growth) but lower-than-expected performance. However, management said they could have done more Azure business if they needed to, but instead took some Azure chips and put them into its core business.

Founded in 1975, Microsoft develops and supports software, services, devices and solutions that help people in business. Products include computer operating systems such as Windows, productivity applications including Excel and Word, software development tools including Azure, computing devices with its Surface tablets, and video games with its Xbox devices. The company also owns the top social media site for business relationships in LinkedIn. Microsoft recently agreed with Nebius for AI infrastructure. Nebius is a European AI infrastructure company that provides storage and compute power needed for AI projects. Demand for Microsoft’s AI systems and cloud services is so strong that the company still can’t keep up, even after adding significant new data center capacity. Nebius adds a turbo boost to Microsoft’s AI growth. Here’s the breakdown of last qtr’s sales growth by division (note commercial cloud isn’t listed):

Microsoft (MSFT) a growth stock that’s also a safe stock. The stock has a solid Estimated Long-Term Growth (Est. LTG) Rate of 16% a year, a dividend yield of 1%, and a stock buyback program. The dividend has been increasing every year since 2006. MSFT is part of the Conservative Growth Portfolio, and Growth Portfolio. Software stocks have been weak lately, MSFT is a bargain now. |

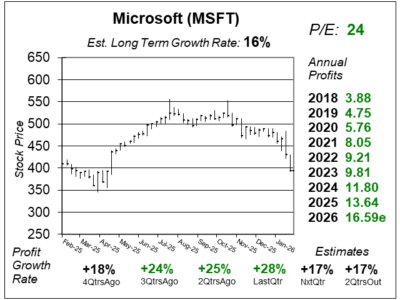

One Year Chart |

Look at this stock’s dive since the New Year! On concerns AI will eat into revenue growth. But Microsoft has some good AI too. Look at this stock’s dive since the New Year! On concerns AI will eat into revenue growth. But Microsoft has some good AI too.

The P/E of 24 is below where it should be. I think the P/E should be 32. It was 32 last qtr, showing how much of a value the stock is this qtr. The Est. LTG is 16%, unchanged from last qtr. This is a good growth rate for a safe stock. Notice qtrly profit growth is expected to be 17% next quarter. If MSFT beats the street, 20% growth is possible. |

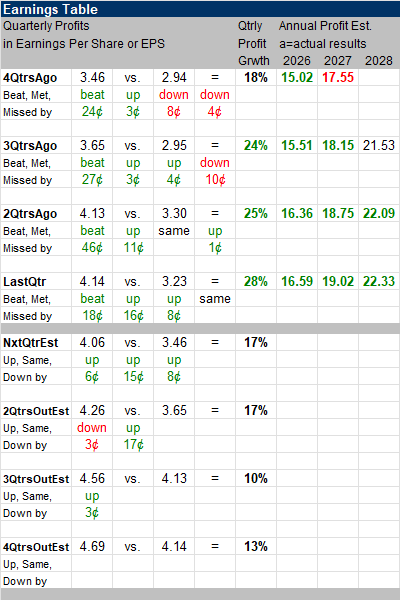

Earnings Table |

Last qtr, Microsoft delivered 28% profit growth and beat estimates of 23%. Revenue increased 17%, year-on-year, and beat estimates of 15%. Last qtr, Microsoft delivered 28% profit growth and beat estimates of 23%. Revenue increased 17%, year-on-year, and beat estimates of 15%.

Annual Profit Estimates all increased this qtr. Microsoft is building out capacity for AI demand, but is balancing Azure revenue growth with growing needs across its own first-party apps and AI solutions. Thus, capacity is expected to be constrained for the next three qtrs at least. Qtrly Profit Estimates are 17%, 17%, 10%, and 13% profit growth for the next 4 qtrs. Analysts believe Microsoft’s revenue will grow 16% next quarter. |

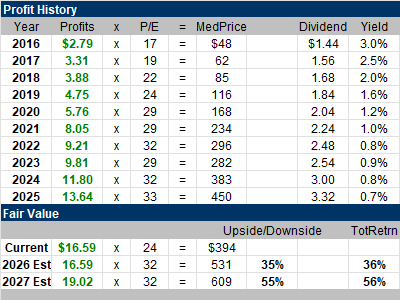

Fair Value |

The stock has a P/E of 24 this quarter. I think this stock is undervalued. The stock has a P/E of 24 this quarter. I think this stock is undervalued.

My Fair Value P/E is 32. That gives the stock ample upside of 35% in 2026 and 55% in 2027. MSFT has a Fiscal Year end on June 30th.

|

Bottom Line |

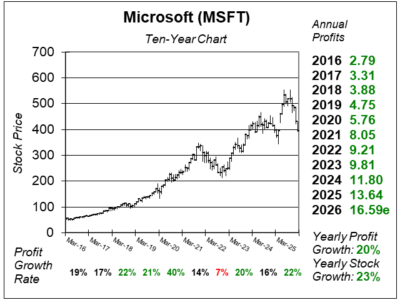

Microsoft (MSFT) has been a stellar stock for much of the last decade. I like this chart. Microsoft (MSFT) has been a stellar stock for much of the last decade. I like this chart.

Software stocks are weak this quarter, but the profits are still strong. I think MSFT will move higher in 2026. MSFT jumps from 12th to 4th in the Conservative Stock Portfolio Power Rankings. The stock’s 2026 upside jumped from 1% to 35% this qtr. MSFT moves from 27th to 16th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

16 of 28Aggressive Growth Portfolio N/AConservative Stock Portfolio 4 of 18 |