About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

Align Technology is having a fabulous year. Align is the company that designs and manufactures Invisalign clear braces and iTero scanners, which dentists use to scan teeth for a fitting. This stock has doubled in the last year and is one of the hottest in the market. But is it too late to buy? I think so. Still, the numbers here are rock solid, so I also expect the shares to continue higher. Here’s some highlights from last qtr:

Align Technology is having a fabulous year. Align is the company that designs and manufactures Invisalign clear braces and iTero scanners, which dentists use to scan teeth for a fitting. This stock has doubled in the last year and is one of the hottest in the market. But is it too late to buy? I think so. Still, the numbers here are rock solid, so I also expect the shares to continue higher. Here’s some highlights from last qtr:

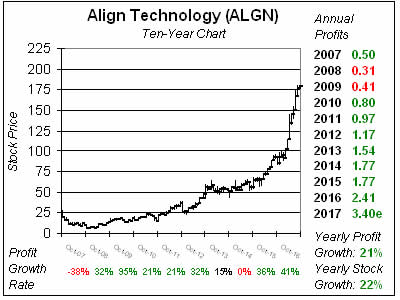

Sales growth of 32% and profit growth of 37% last qtr. Profit estimates were just 18% and the company whipped that figure. Also, profit estimates climbed across the board this qtr, with 2017’s est rising from $3.19 to $3.40. Qtrly profit Estimates are

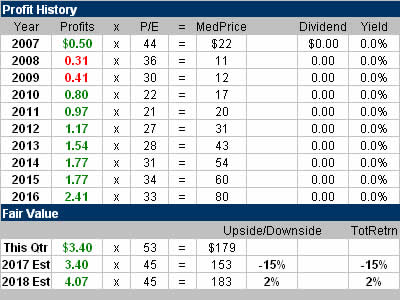

Sales growth of 32% and profit growth of 37% last qtr. Profit estimates were just 18% and the company whipped that figure. Also, profit estimates climbed across the board this qtr, with 2017’s est rising from $3.19 to $3.40. Qtrly profit Estimates are  My Fair Value is a P/E of 45. That gives me a Fair Value of $153 and honestly I’d love to buy in at that price. 2018’s FV is $183 but since annual estimates just jumped I think it’s possible this company could make $5 next year, and a P/E of 45 on that figure would be a $210 stock. Hypothetically of course.

My Fair Value is a P/E of 45. That gives me a Fair Value of $153 and honestly I’d love to buy in at that price. 2018’s FV is $183 but since annual estimates just jumped I think it’s possible this company could make $5 next year, and a P/E of 45 on that figure would be a $210 stock. Hypothetically of course. Align Technologies is one of the best stocks in the market, but after a tremendous run the stock has gone parabolic and is dangerous to buy here. The problem is now I have to wait for a pullback to get in, and that seems unlikely with the solid sales numbers that are coming in. ALGN is on the top of my radar, but I feel we need a stock market correction for this stock to fall to a buyable level. If it were too I would likely add it to the

Align Technologies is one of the best stocks in the market, but after a tremendous run the stock has gone parabolic and is dangerous to buy here. The problem is now I have to wait for a pullback to get in, and that seems unlikely with the solid sales numbers that are coming in. ALGN is on the top of my radar, but I feel we need a stock market correction for this stock to fall to a buyable level. If it were too I would likely add it to the