Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial

|

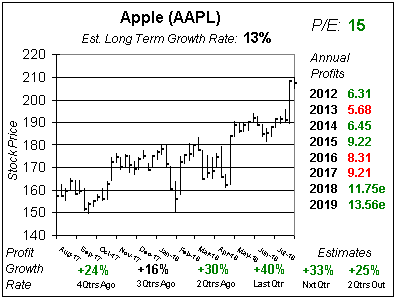

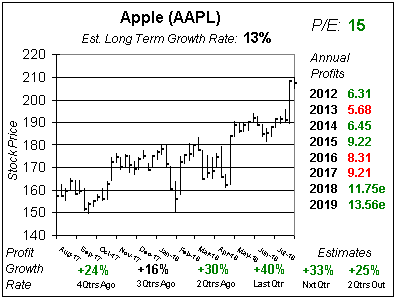

There’s been a big shakeup within the top stocks in the market this quarter. Lots of names have fallen in my Power Rankings. Especially Chinese internet stocks. Thus there’s a new leader in my Power Rankings — Apple (AAPL). To be on top in my Power Rankings, a stock has to: There’s been a big shakeup within the top stocks in the market this quarter. Lots of names have fallen in my Power Rankings. Especially Chinese internet stocks. Thus there’s a new leader in my Power Rankings — Apple (AAPL). To be on top in my Power Rankings, a stock has to:

- be a big company, to provide stability

- have good upside to my Fair Value

- have high profit growth

- have a reasonable P/E

- be on an uptrend

- have good profit estimates and

- be beating the street

Apple fits the mold as it’s:

- the largest stock in the world

- has upside of 18% and 30% to this year’s/next year’s Fair Values

- grew profits 40% last qtr

- with a P/E of only 15 and

- is at an All-Time high with

- 33% and 25% profit growth expected the next 2 qtrs and

- beat analysts estimates of $2.18 by 16 cents

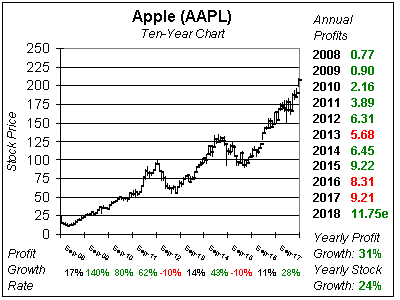

Apple has historically had a low valuation. Profits have grown 31% a year the past decade, yet the stock has had a P/E of only around 16. This stock should have a P/E between 20 and 25. The reason it doesn’t is people characterize it as a hardware company, which is dependent on new product releases to spur profit growth (profits declined in 2013 and 2016). But now people might think of AAPL in a brighter light as service revenue accounted for 18% of total revenue last qtr, up from 15% of sales last qtr, and around 7% just a couple of years back. Here’s some bullet points from last qtr:

- Service revenue increased 28% including…

- Paid subscriptions from Apple and third parties just surpassed 300 million, up more than 60% in the last year alone.

- Apple Music grew faster than 50%

- Cloud revenue was also up greater than 50%

- Apple Pay had tripe the transactions from a year ago, with well over 1 billion, which was more than Square

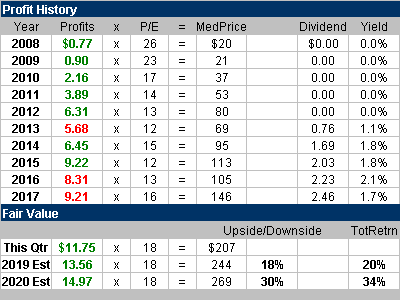

In addition, iPhone sales jumped 20%, with double-digit unit growth in the U.S, Canada, Germany, Switzerland, Mexico, Hong Kong, Russia, the Middle East and Africa. Wearables (Apple Watch, AirPods, Beats) had 60% growth, with Apple Watch delivering mid-40% growth and becoming more advanced for fitness. Management also returned almost $25 billion to investors including $3.7 billion in dividends and $20 billion in Apple shares. This stock looks fantastic, and at around $207 has 18% upside to my current year (2019) Fair Value of $244. That assumes just a P/E of just 18. Next qtr I’ll likely take my Fair Value to a P/E of 20, which would be $271 a share (with current estimates). Apple is my top ranked stock in my Growth Portfolio and Conservative Growth Portfolio Power Rankings. |

This is the 2nd solid breakout the stock’s had in the last four months. That’s a bullish sign. Last qtr the company delivered 40% profit growth, which beat estimates of 31%, as sales increased 17%, the 7th consecutive qtr of accelerating sales growth. Qtrly profit estimates also increased, and now analysts expect 33%, 25%, 13% and 8% profit growth the next 4 qtrs. Although the stock is up from $185 to $207 since last qtr, the P/E has decreased from 16 to 15 as AAPL has its fiscal year-end on September 30th and I’m now looking ahead to 2019 estimates. Overall the stock has an Est. LTG of 13% per year in addition to a 2% yield for an estimated total annual return of 15% a year (hypothetically). This is the 2nd solid breakout the stock’s had in the last four months. That’s a bullish sign. Last qtr the company delivered 40% profit growth, which beat estimates of 31%, as sales increased 17%, the 7th consecutive qtr of accelerating sales growth. Qtrly profit estimates also increased, and now analysts expect 33%, 25%, 13% and 8% profit growth the next 4 qtrs. Although the stock is up from $185 to $207 since last qtr, the P/E has decreased from 16 to 15 as AAPL has its fiscal year-end on September 30th and I’m now looking ahead to 2019 estimates. Overall the stock has an Est. LTG of 13% per year in addition to a 2% yield for an estimated total annual return of 15% a year (hypothetically). |

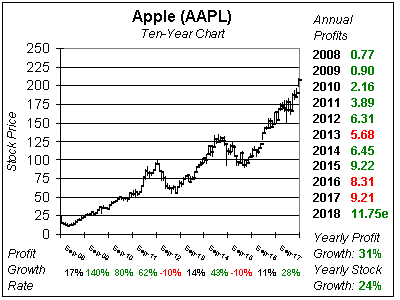

Apple has had its ups-and-downs the past decade, but now that the stock’s at an All-Time high the ten-year chart looks great. Also, the stock’s growth hasn’t kept up with the profit growth, so AAPL could have some catching up to do. A decade ago this company had a P/E in the 20s, and now with business booming again that valuation could be on the horizon. Plus, there are a lot of great growth stocks that have had estimates cut — including a social network and some big name Chinese stocks — and smart institutions are likely selling. That means more money to invest. To invest in what’s hot. AAPL is my top ranked stock in the Conservative Growth Portfolio, Growth Portfolio and Aggressive Growth Portfolio Power Rankings. Apple has had its ups-and-downs the past decade, but now that the stock’s at an All-Time high the ten-year chart looks great. Also, the stock’s growth hasn’t kept up with the profit growth, so AAPL could have some catching up to do. A decade ago this company had a P/E in the 20s, and now with business booming again that valuation could be on the horizon. Plus, there are a lot of great growth stocks that have had estimates cut — including a social network and some big name Chinese stocks — and smart institutions are likely selling. That means more money to invest. To invest in what’s hot. AAPL is my top ranked stock in the Conservative Growth Portfolio, Growth Portfolio and Aggressive Growth Portfolio Power Rankings. |

There’s been a big shakeup within the top stocks in the market this quarter. Lots of names have fallen in my Power Rankings. Especially Chinese internet stocks. Thus there’s a new leader in my Power Rankings — Apple (AAPL). To be on top in my Power Rankings, a stock has to:

There’s been a big shakeup within the top stocks in the market this quarter. Lots of names have fallen in my Power Rankings. Especially Chinese internet stocks. Thus there’s a new leader in my Power Rankings — Apple (AAPL). To be on top in my Power Rankings, a stock has to:

This is the 2nd solid breakout the stock’s had in the last four months. That’s a bullish sign. Last qtr the company delivered 40% profit growth, which beat estimates of 31%, as sales increased 17%, the 7th consecutive qtr of accelerating sales growth. Qtrly profit estimates also increased, and now analysts expect

This is the 2nd solid breakout the stock’s had in the last four months. That’s a bullish sign. Last qtr the company delivered 40% profit growth, which beat estimates of 31%, as sales increased 17%, the 7th consecutive qtr of accelerating sales growth. Qtrly profit estimates also increased, and now analysts expect  Note the back-to-back non-record years in 2016 & 2017. As well as 2013. Those are why AAPL doesn’t have a high P/E. But Apple is now being seen in a different light, and should have a higher P/E. This qtr my Fair Value is a P/E of 18, but I’ll look to bump this up to 20 next qtr if the stock continues to climb. Note the Fair Values are on 2019 and 2020 estimates.

Note the back-to-back non-record years in 2016 & 2017. As well as 2013. Those are why AAPL doesn’t have a high P/E. But Apple is now being seen in a different light, and should have a higher P/E. This qtr my Fair Value is a P/E of 18, but I’ll look to bump this up to 20 next qtr if the stock continues to climb. Note the Fair Values are on 2019 and 2020 estimates. Apple has had its ups-and-downs the past decade, but now that the stock’s at an All-Time high the ten-year chart looks great. Also, the stock’s growth hasn’t kept up with the profit growth, so AAPL could have some catching up to do. A decade ago this company had a P/E in the 20s, and now with business booming again that valuation could be on the horizon. Plus, there are a lot of great growth stocks that have had estimates cut — including a social network and some big name Chinese stocks — and smart institutions are likely selling. That means more money to invest. To invest in what’s hot. AAPL is my top ranked stock in the

Apple has had its ups-and-downs the past decade, but now that the stock’s at an All-Time high the ten-year chart looks great. Also, the stock’s growth hasn’t kept up with the profit growth, so AAPL could have some catching up to do. A decade ago this company had a P/E in the 20s, and now with business booming again that valuation could be on the horizon. Plus, there are a lot of great growth stocks that have had estimates cut — including a social network and some big name Chinese stocks — and smart institutions are likely selling. That means more money to invest. To invest in what’s hot. AAPL is my top ranked stock in the